Home repossession is a challenging and often distressing process for homeowners facing financial difficulties. When mortgage payments are missed, lenders may initiate a series of steps that can ultimately lead to the loss of a property. Understanding home repossession stages is crucial for homeowners to navigate this process, explore options to prevent it, and protect their rights. This comprehensive guide breaks down the key phases of home repossession, offering clarity and actionable insights for those at risk of losing their homes.

What Is Home Repossession?

Home repossession occurs when a lender takes back a property due to the homeowner’s inability to meet mortgage payment obligations. This legal process is typically a last resort for lenders, initiated after repeated missed payments and failed attempts to resolve the debt. Understanding home repossession stages begins with recognizing that this is not an overnight event but a structured process governed by laws that vary by state or country. Homeowners often have opportunities to intervene at different points to avoid losing their property.

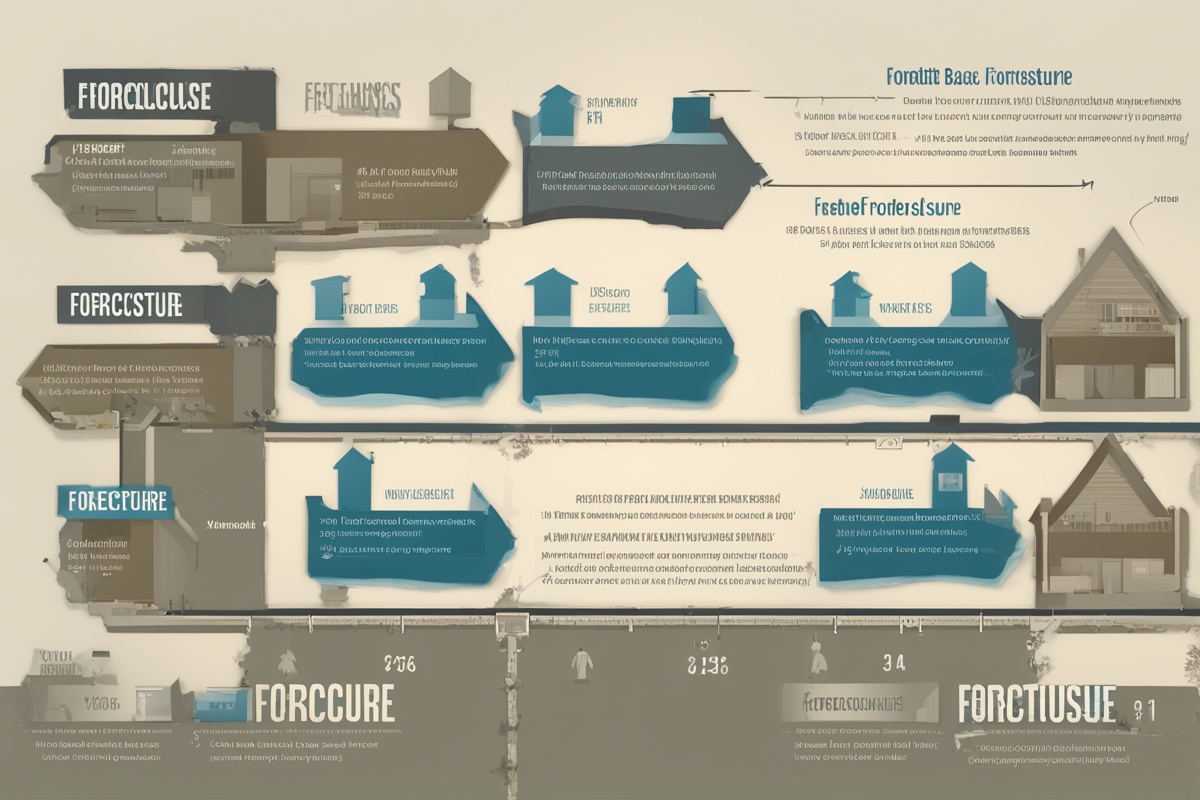

Stage 1: Missed Payments and Initial Notices

The first stage of home repossession begins when a homeowner misses one or more mortgage payments. Lenders usually send a notice of default or a late payment reminder, often within 15–30 days of the missed payment. This communication serves as a warning, urging the borrower to bring their account current. At this point, it’s critical to communicate with the lender to discuss potential solutions like payment plans or temporary forbearance. Ignoring these notices can escalate the situation, moving it closer to formal repossession proceedings. For more information on managing missed payments, check out our guide on mortgage payment assistance options.

Stage 2: Notice of Default and Pre-Foreclosure Period

If payments remain unpaid for a prolonged period—typically 90 days—lenders may issue a formal Notice of Default (NOD). This document signals the official start of the foreclosure process in many jurisdictions. The pre-foreclosure period, which follows the NOD, often lasts 30–120 days, depending on local laws. During this time, homeowners have the chance to reinstate the loan by paying the overdue amount plus fees or to negotiate alternatives such as a loan modification. Understanding home repossession stages at this point is vital, as proactive steps can still prevent the loss of the home. Learn more about loan modification in our detailed post on navigating loan modifications.

Stage 3: Foreclosure Filing and Legal Proceedings

If the homeowner fails to resolve the delinquency during the pre-foreclosure period, the lender may file a foreclosure lawsuit or proceed with a non-judicial foreclosure, depending on the state’s regulations. In judicial foreclosure states, the process involves a court hearing where the lender must prove the borrower’s default. Non-judicial foreclosures, on the other hand, follow a predefined legal process without court involvement but still adhere to strict timelines and notice requirements. Homeowners may receive a Notice of Sale, indicating that the property will be auctioned if the debt remains unpaid. This stage underscores the importance of seeking legal advice, as explored in our article on finding foreclosure legal assistance.

Stage 4: Property Auction and Sale

Once the foreclosure process reaches the auction stage, the property is sold to the highest bidder at a public sale. The date and details of the auction are typically published in local newspapers or online platforms as required by law. If no bids meet the lender’s minimum reserve price, the property may become Real Estate Owned (REO) by the lender. Homeowners lose ownership at this point, though some states allow a redemption period during which they can reclaim the property by paying the full debt plus costs. Understanding home repossession stages during the auction phase can be emotionally taxing, but knowing your rights is essential. For tips on dealing with REO properties, refer to our guide on understanding REO properties.

Stage 5: Eviction and Post-Foreclosure Consequences

After the property is sold, the new owner—whether a third party or the lender—gains the right to take possession. If the original homeowner has not vacated the premises, an eviction notice will be issued, and legal proceedings may follow to remove them. Post-foreclosure, the impact on the homeowner’s credit score can be severe, often dropping by 200–300 points and remaining on the credit report for seven years. Additionally, there may be tax implications if the lender forgives part of the debt, treated as taxable income in some cases. Understanding home repossession stages includes preparing for these long-term consequences. For help rebuilding credit after foreclosure, see our resource on credit repair strategies post-foreclosure.

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as legal, financial, or professional advice. Home repossession laws and processes vary widely by state and country, and individual circumstances can significantly affect outcomes. We strongly recommend consulting with a qualified attorney, financial advisor, or housing counselor to address your specific situation before making any decisions related to foreclosure or home repossession.

References

- Consumer Financial Protection Bureau – What is Foreclosure?

- U.S. Department of Housing and Urban Development – Avoiding Foreclosure

- Nolo – Understanding the Foreclosure Process

- Federal Reserve – Foreclosure Resources for Consumers

- Internal Revenue Service – Tax Consequences of Foreclosure

This content is for informational purposes only and not a substitute for professional advice.