Navigating the choppy waters of home repossession can feel like a gut punch, especially if you’re staring down the barrel of financial hardship. The process is complex, emotionally draining, and often misunderstood. But here’s the good news: by truly understanding home repossession stages, you can arm yourself with knowledge, spot potential pitfalls, and maybe even find a way to steer clear of losing your home. I’ve seen friends and clients wrestle with this firsthand, and I’ve spent years digging into the nitty-gritty of foreclosure timelines to help shed light on what’s often a shadowy process. So, let’s break it down step by step, with practical insights and a clear roadmap to guide you through.

What Is Home Repossession, Really?

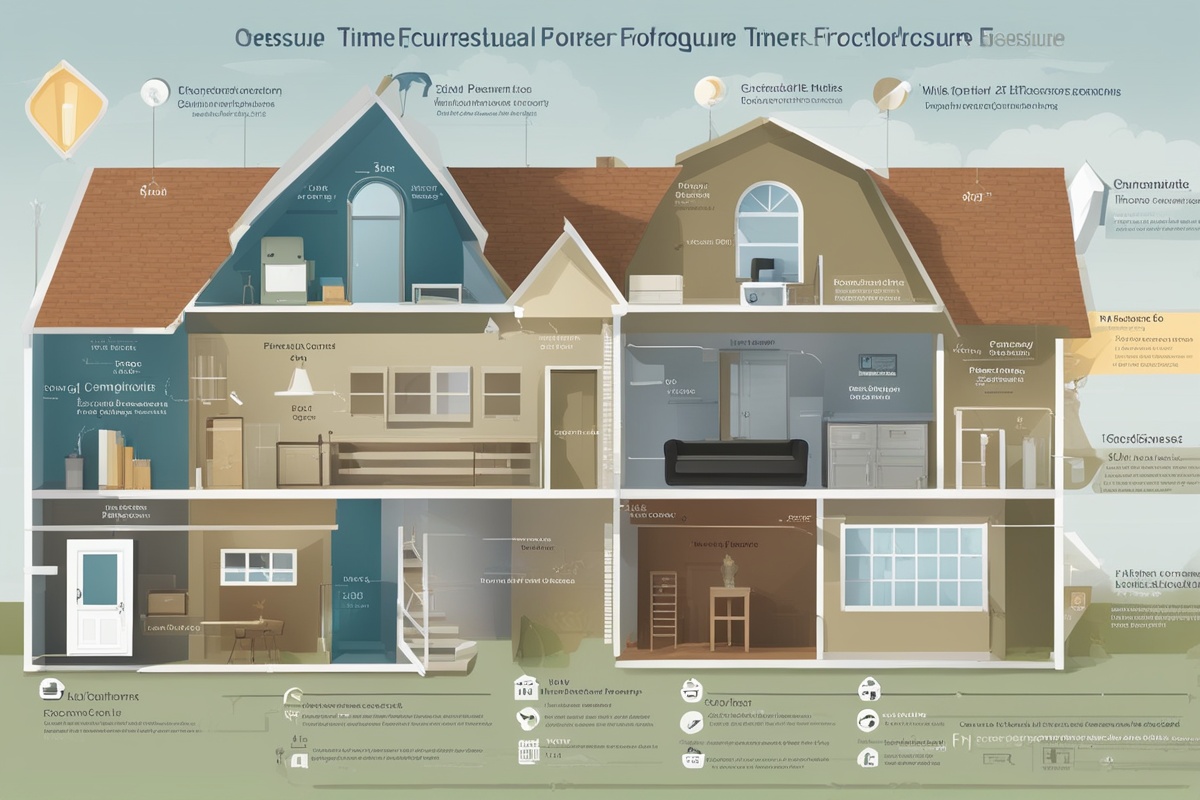

At its core, home repossession—often interchangeable with “foreclosure” in many contexts—is the legal process by which a lender takes back a property when a borrower fails to meet mortgage payments. It’s not just a fancy term for “losing your house”; it’s a structured, multi-stage ordeal that can span months or even years. Imagine you’re a homeowner who’s missed a few payments due to a job loss. The bank doesn’t just show up one day with an eviction notice. There’s a timeline, and understanding home repossession stages can mean the difference between panic and a plan.

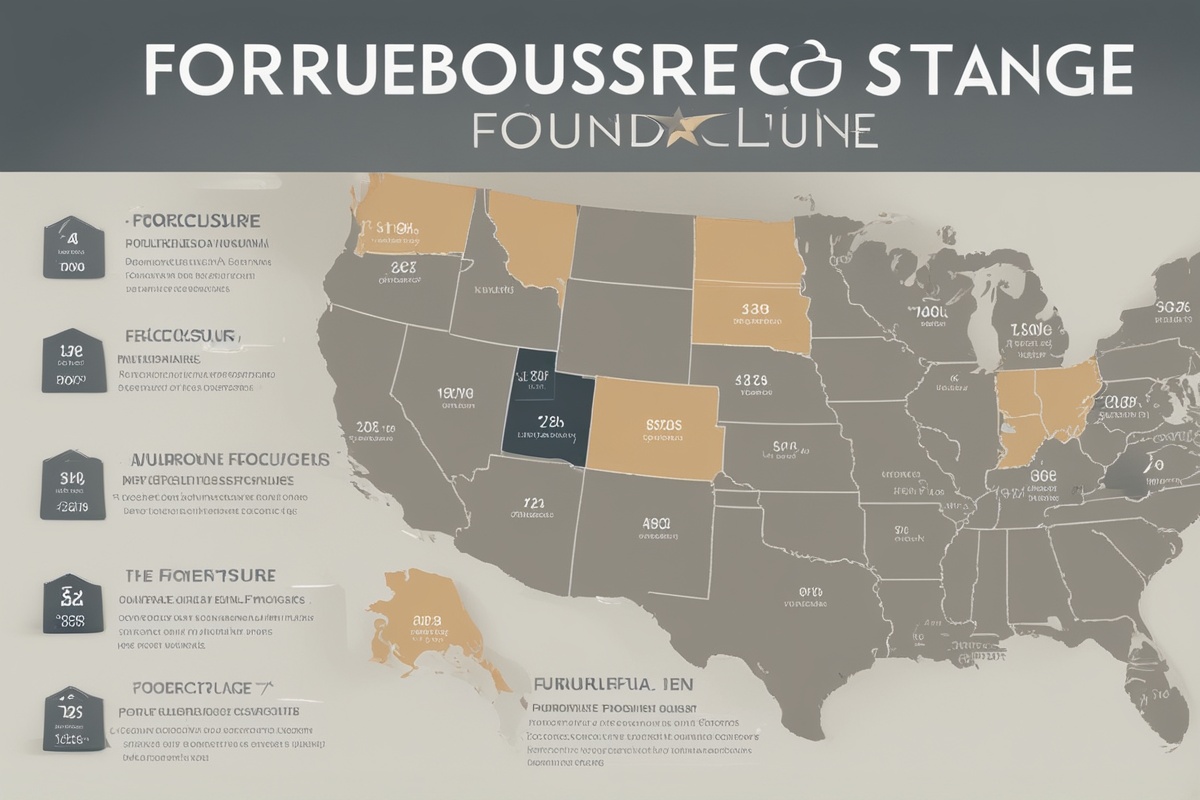

Repossession isn’t a snap decision by lenders either. They often lose money in the process, so many are willing to work with borrowers to avoid it. But if push comes to shove, they’ll follow a legal framework to reclaim the property. This process varies depending on whether you’re in a judicial or non-judicial foreclosure state (more on that later), but the core stages remain similar. Let’s dive into them.

Stage 1: Missed Payments and the First Warning Signs

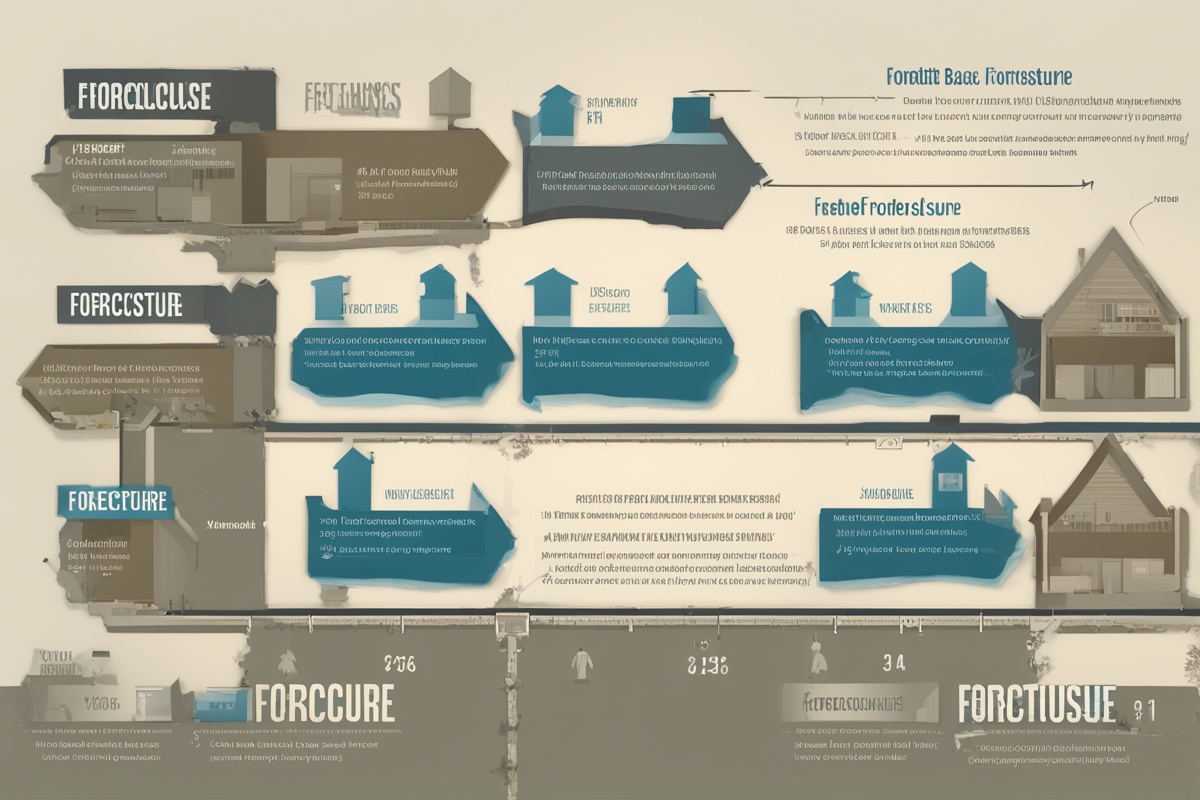

The journey often starts with something as simple—and stressful—as missing a mortgage payment. Life happens. Maybe a medical emergency drained your savings, or a sudden layoff left you scrambling. Typically, lenders won’t bat an eye if you’re a day or two late. But once you hit the 30-day mark, you’re officially “delinquent,” and the clock starts ticking.

At this point, you’ll likely get a friendly (or not-so-friendly) reminder from your lender via mail or phone. I remember a client who ignored these early notices, thinking, “I’ll catch up next month.” Spoiler: that “next month” never came, and the problem snowballed. Don’t sleep on these warnings. Many lenders offer grace periods or hardship programs if you reach out early. The key takeaway? Communication is your lifeline. Pick up the phone, explain your situation, and ask about options like forbearance or loan modification.

Stage 2: Notice of Default—The Official Red Flag

If you’re 90 to 120 days behind—again, this varies by lender and state—you’ll likely receive a Notice of Default (NOD). This is the lender’s way of saying, “We’re serious now.” It’s a formal document filed with the local court (in judicial states) or sent directly to you (in non-judicial states), signaling that foreclosure proceedings are on the horizon if you don’t act.

Here’s where things get real. The NOD often gives you a window—usually 30 days—to bring your account current or negotiate an alternative. I’ve seen homeowners at this stage successfully apply for a loan modification, which adjusts the terms of the mortgage to make payments more manageable. Curious about loan modifications? Check out our detailed guide on Loan Modification Basics for a deeper dive. The bottom line is, don’t bury your head in the sand. This stage is your wake-up call to explore every option.

Stage 3: Pre-Foreclosure and Last-Ditch Efforts

Once the NOD is issued, you enter the pre-foreclosure phase. This period can last anywhere from 30 to 120 days, depending on local laws. It’s a critical window where you can still save your home—or at least mitigate the damage. Lenders may offer a reinstatement option, meaning you pay the overdue amount plus fees to get back on track. Alternatively, a short sale—selling the home for less than what’s owed—might be on the table if reinstatement isn’t feasible.

Picture this: You’re underwater on your mortgage, and there’s no way to catch up. A short sale could preserve your credit better than a full foreclosure. I once advised a family in this exact spot, and while they lost the house, they avoided the worst credit hit and walked away with a fresh start. Want to know more about short sales? We’ve got a comprehensive piece on Understanding Short Sales that breaks it down. This stage is all about weighing your options with a clear head.

Stage 4: Foreclosure Auction or Sale

If no resolution is reached during pre-foreclosure, the lender moves to sell the property, often through a public auction. In judicial states, this follows a court process where a judge approves the foreclosure. In non-judicial states, it’s faster, guided by a “power of sale” clause in the mortgage contract. Either way, this is where the lender aims to recoup their losses by selling your home to the highest bidder.

What’s wild is how quickly this can happen once the ball gets rolling. I recall a case where a homeowner didn’t realize their property was auctioned until a stranger showed up claiming ownership. It’s rare, but it happens if you’re not staying on top of notices. At this point, redemption rights—your ability to reclaim the property by paying the full debt—may still exist in some states, but they’re often a long shot. If you’re curious about state-specific rules, our article on State-by-State Foreclosure Laws is a great resource.

Stage 5: Eviction and Post-Foreclosure Fallout

If the home sells at auction (or if the lender takes ownership through a “deed in lieu of foreclosure”), the final stage is eviction. You’ll receive a formal notice to vacate, often with a tight deadline of 3 to 30 days. It’s a brutal reality, but not the end of the world. Some states offer “cash for keys” programs, where the lender pays you a small sum to leave peacefully and in good condition.

The aftermath isn’t just about losing a roof over your head. A foreclosure can tank your credit score by 100-300 points, making renting or future home-buying a nightmare for 7 years or more. But here’s a silver lining: I’ve seen people rebuild. One acquaintance started by renting, repairing their credit with secured cards, and eventually bought again after a decade. It’s a marathon, not a sprint. Focus on small, consistent steps post-foreclosure to regain financial stability.

How to Navigate or Avoid Repossession: Actionable Tips

Now that we’ve walked through the stages, let’s talk survival. First, don’t wait to act. The earlier you address missed payments, the more options you have. Contact your lender at the first sign of trouble—many have hardship programs, especially post-pandemic. Second, consider housing counseling. HUD-approved counselors can negotiate on your behalf for free or at low cost. I’ve seen them work miracles for clients who thought all hope was lost.

Third, explore government programs like the Home Affordable Modification Program (HAMP) if you’re eligible. Lastly, know your rights. Some states require lenders to offer mediation or delay proceedings under certain conditions. Knowledge is power, and understanding home repossession stages equips you to fight back—or at least exit with dignity.

Final Thoughts: There’s Always a Path Forward

Losing a home is heartbreaking, no question. But it’s not a dead end. Whether you’re in the early stages of delinquency or staring down an auction date, there are ways to soften the blow or even turn things around. I’ve witnessed people bounce back from worse, and with the right mindset and resources, so can you. Have you or someone you know faced repossession? What strategies helped? Drop a comment—I’d love to hear your story and keep this conversation going.

References

- U.S. Department of Housing and Urban Development (HUD) – Avoiding Foreclosure

- Consumer Financial Protection Bureau (CFPB) – What is Foreclosure?

- Nolo – Understanding the Foreclosure Process

- Federal Reserve – Resources on Foreclosures

This content is for informational purposes only and not a substitute for professional advice.