In the ever-evolving real estate market, understanding niche trends can provide investors with a significant edge. One such area of interest is distressed properties—homes or commercial spaces that are in poor condition, often due to financial or legal issues faced by the owner. Analyzing distressed property trends offers valuable insights for investors, real estate professionals, and even policymakers looking to address housing challenges. This comprehensive guide dives into the factors driving distressed property trends, their impact on the market, and strategies for capitalizing on these opportunities.

What Are Distressed Properties?

Distressed properties refer to real estate assets that are under financial or physical stress. These properties are often sold below market value due to circumstances such as foreclosure, bankruptcy, or significant disrepair. Owners of distressed properties may be unable to maintain or sell the property at a competitive price, making these assets attractive to investors willing to take on the associated risks. Analyzing distressed property trends involves understanding the root causes of distress, such as economic downturns, high interest rates, or localized issues like job loss in a specific region.

These properties can range from single-family homes to multi-unit apartment complexes or commercial spaces. The common thread is that they represent an opportunity for buyers to acquire real estate at a discount, provided they can navigate the complexities of rehabilitation or legal hurdles.

Key Drivers Behind Distressed Property Trends

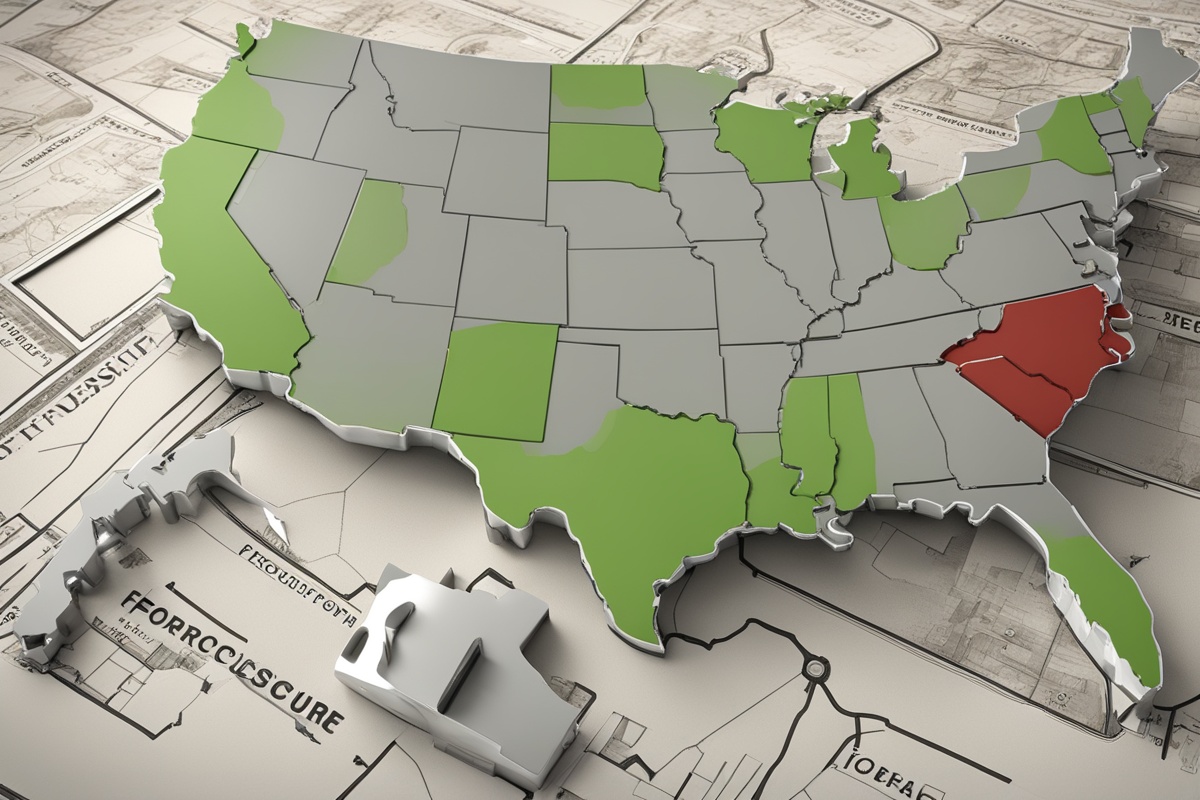

Several macroeconomic and microeconomic factors contribute to the rise or fall of distressed property trends. Economic recessions, for instance, often lead to an increase in foreclosures as homeowners struggle to meet mortgage payments. According to recent data, periods of high unemployment correlate strongly with spikes in distressed property listings. Additionally, rising interest rates can exacerbate financial strain for property owners with adjustable-rate mortgages, pushing more properties into distress.

On a local level, factors such as declining industries or natural disasters can create pockets of distressed properties. For example, areas hit by hurricanes or floods often see a surge in properties that owners can no longer afford to repair. Analyzing distressed property trends requires a close look at these drivers to predict where opportunities—or risks—may emerge.

The Impact of Distressed Properties on the Real Estate Market

Distressed properties have a ripple effect on the broader real estate market. When a significant number of these properties are sold at discounted prices, they can depress property values in the surrounding area. This creates challenges for homeowners looking to sell or refinance their properties at market rates. However, it also opens doors for investors who can buy low, renovate, and either sell or rent for a profit.

Moreover, distressed property trends can influence local economies. High concentrations of distressed properties often correlate with reduced tax revenues for municipalities, as property values decline. On the flip side, revitalization efforts by investors can breathe new life into struggling neighborhoods. For more insights on how real estate trends impact local markets, check out our detailed guide on Real Estate Market Dynamics.

How to Analyze Distressed Property Trends Effectively

Analyzing distressed property trends requires a blend of data analysis and on-the-ground research. Start by leveraging public records to track foreclosure rates, bankruptcy filings, and short sales in your target area. Online platforms and real estate databases can provide historical data on distressed property sales, helping you identify patterns over time.

Additionally, consider partnering with local real estate agents who specialize in distressed properties. They can offer insights into specific neighborhoods and connect you with off-market deals. Tools like geographic information systems (GIS) can also help map out areas with high concentrations of distressed properties, allowing for more targeted investment strategies. For a deeper dive into real estate analytics, explore our post on Using Data to Drive Real Estate Decisions.

Investment Opportunities and Risks in Distressed Properties

Investing in distressed properties can be highly lucrative, but it comes with inherent risks. On the opportunity side, these properties are often priced well below market value, offering substantial profit margins if renovated and sold or rented out. Fix-and-flip investors, for instance, frequently target distressed properties to capitalize on quick turnarounds.

However, the risks are notable. Distressed properties may come with legal entanglements, such as liens or unresolved ownership disputes. Physical issues, like structural damage or environmental hazards (e.g., mold or asbestos), can also inflate renovation costs. Investors must conduct thorough due diligence and budget for unexpected expenses. To learn more about managing investment risks, read our article on Navigating Real Estate Investment Risks.

Future Outlook for Distressed Property Trends

The future of distressed property trends will largely depend on broader economic conditions. If interest rates continue to rise, more homeowners may struggle with mortgage payments, potentially increasing the supply of distressed properties. Conversely, government interventions—such as mortgage relief programs or housing initiatives—could mitigate these trends by providing support to struggling property owners.

Technological advancements are also reshaping how investors approach distressed properties. Artificial intelligence and machine learning tools are being used to predict foreclosure risks and identify undervalued properties before they hit the market. Staying ahead of these technological and economic shifts will be crucial for anyone looking to capitalize on distressed property opportunities. For more on emerging real estate tech, see our piece on Technology in Real Estate Investing.

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as financial, legal, or investment advice. Investing in distressed properties carries significant risks, and readers are encouraged to consult with qualified professionals, such as financial advisors or real estate experts, before making any investment decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this content.

References

- Federal Reserve – Survey of Consumer Finances (2023)

- Realtor.com – Real Estate Market Trends Report

- U.S. Department of Housing and Urban Development – Housing Market Analysis

- CoreLogic – Foreclosure Trends Report

- National Bureau of Economic Research – Economic Impact of Distressed Properties

This content is for informational purposes only and not a substitute for professional advice.