The distressed property market has long been a focal point for investors seeking high returns, but it is also a complex and often misunderstood segment of real estate. Understanding the nuances of distressed properties—those facing foreclosure, short sales, or significant financial distress—can unlock opportunities for savvy buyers while also shedding light on broader economic trends. This post dives deep into Distressed Property Market Insights, exploring key trends, challenges, and strategies to navigate this unique sector of the real estate market.

What Defines a Distressed Property?

A distressed property is typically a real estate asset that is under financial strain, often due to the owner’s inability to meet mortgage payments or maintain the property. These properties may be in foreclosure, subject to a short sale, or owned by a bank (commonly referred to as REO, or Real Estate Owned, properties). Distressed properties often sell below market value, making them attractive to investors, but they come with risks such as legal complications, structural issues, or liens.

Understanding the definition of distressed properties is the first step in gaining valuable Distressed Property Market Insights. These properties are often tied to broader economic conditions, such as rising unemployment rates or interest rate hikes, which can increase the number of homeowners defaulting on loans. For a deeper look into real estate terminology, check out our post on Real Estate Investment Basics.

Current Trends in the Distressed Property Market

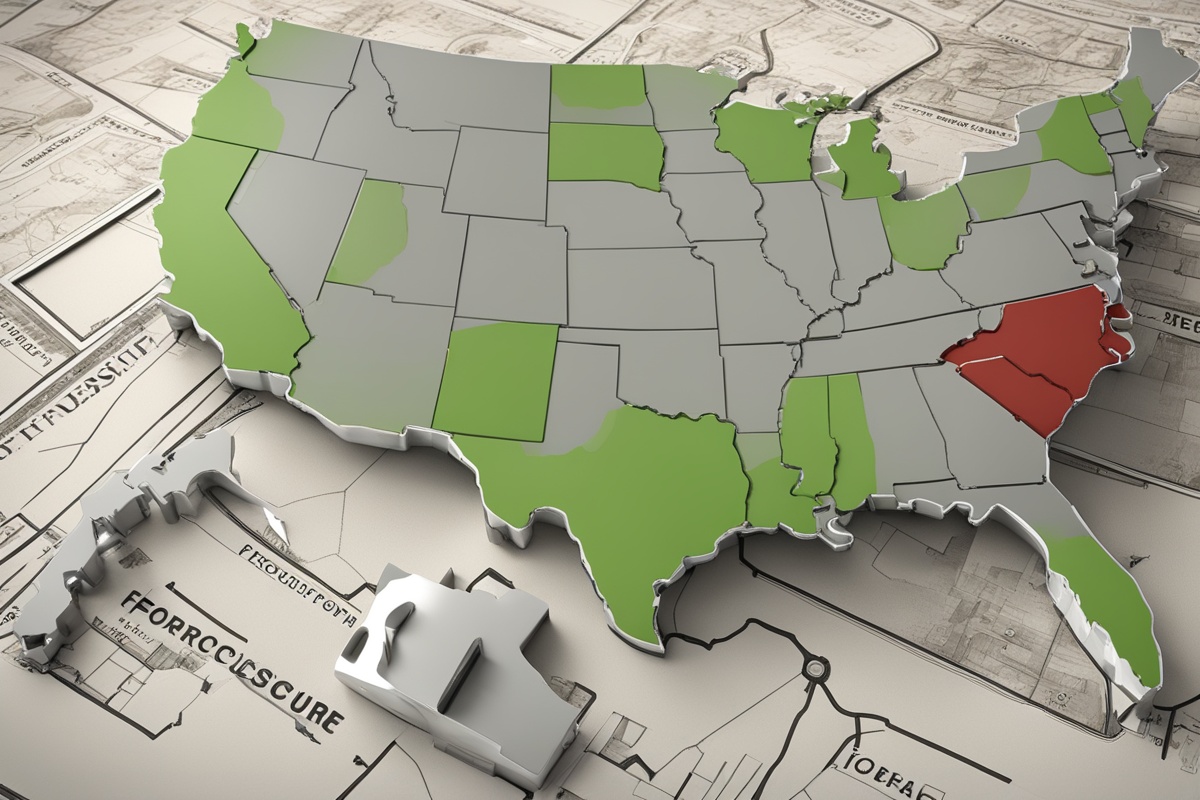

As of recent years, the distressed property market has seen fluctuations driven by economic uncertainty, inflation, and changing mortgage rates. According to industry reports, foreclosure rates have risen in certain regions due to post-pandemic financial recovery challenges. However, the overall volume of distressed properties remains below the peaks seen during the 2008 financial crisis.

One notable trend is the increased competition among investors for distressed properties. With institutional buyers and hedge funds entering the market, individual investors must act quickly and strategically. Additionally, geographic disparities play a role—areas with higher unemployment or stagnant wage growth often see a larger inventory of distressed homes. For more on regional market trends, explore our analysis in Regional Real Estate Market Shifts.

Opportunities for Investors in Distressed Properties

The primary allure of distressed properties lies in their below-market pricing, which can yield significant returns through renovation and resale (commonly known as “fix and flip”) or long-term rental income. Investors with access to capital and expertise in property rehabilitation can turn distressed assets into profitable ventures.

However, success in this market requires thorough due diligence. Investors must assess the property’s condition, research liens or legal issues, and calculate renovation costs. Leveraging tools like property data platforms or partnering with local real estate agents can provide critical Distressed Property Market Insights. If you’re new to investing, our guide on Getting Started with Real Estate Investments offers actionable tips.

Challenges and Risks in the Distressed Property Market

While the potential rewards are high, the distressed property market is fraught with challenges. Properties may require extensive repairs, and unforeseen costs can erode profit margins. Legal hurdles, such as evicting occupants or resolving title issues, can delay projects and increase expenses. Moreover, the emotional toll of dealing with homeowners in distress should not be underestimated—ethical considerations often come into play.

Market volatility also poses a risk. Economic downturns can depress property values, making it harder to resell a renovated distressed property at a profit. Staying informed about economic indicators is crucial for mitigating these risks. For insights into broader economic trends, read our article on Economic Factors Impacting Real Estate.

Strategies for Navigating the Distressed Property Market

Successfully investing in distressed properties requires a well-thought-out approach. First, build a network of professionals, including real estate agents, contractors, and attorneys, who can assist with identifying and managing distressed assets. Second, focus on data-driven decision-making—use market analysis tools to identify areas with high foreclosure rates or undervalued properties.

Financing is another critical factor. Many distressed properties are sold “as-is,” and traditional lenders may be hesitant to finance them. Exploring alternative financing options, such as hard money loans, can provide the necessary capital. Finally, always have an exit strategy—whether it’s flipping the property or renting it out, know your end goal before purchasing. For more on financing options, see our detailed post on Real Estate Financing Solutions.

The Future Outlook for Distressed Properties

Looking ahead, the distressed property market is likely to evolve in response to macroeconomic factors. Rising interest rates could lead to more defaults, increasing the supply of distressed properties. At the same time, government interventions, such as foreclosure moratoriums or homeowner assistance programs, may temper this growth. Investors who stay informed about policy changes and economic forecasts will be better positioned to capitalize on opportunities.

Technology is also reshaping the market, with online platforms making it easier to find and bid on distressed properties. As the market becomes more accessible, competition may intensify, underscoring the importance of niche expertise and local knowledge in gaining Distressed Property Market Insights.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial, legal, or investment advice. Investing in distressed properties carries significant risks, and individuals should conduct their own research and consult with qualified professionals before making any investment decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this content.

References

- Federal Reserve – Economic Reports on Housing and Foreclosures

- Realtor.com – Real Estate Market Trends and Data

- U.S. Department of Housing and Urban Development – Foreclosure Resources

- U.S. Census Bureau – Housing Vacancies and Homeownership

- National Association of Realtors – Research and Statistics

This content is for informational purposes only and not a substitute for professional medical advice.