Navigating the world of foreclosure investing requires a keen understanding of the distressed property market trends. Investors looking to capitalize on opportunities in this niche must stay informed about market dynamics, economic factors, and regional variations that impact the availability and profitability of distressed properties. In this in-depth market analysis, we’ll explore the current state of the distressed property market, key trends shaping foreclosure investing, and actionable insights for investors seeking to make informed decisions.

Understanding the Distressed Property Market in Foreclosure Investing

The distressed property market is a cornerstone of foreclosure investing, encompassing properties that are in financial distress due to missed mortgage payments, liens, or other legal issues. These properties often end up in foreclosure, creating opportunities for investors to purchase them at below-market prices. However, the distressed property market trends are influenced by broader economic conditions such as interest rates, unemployment rates, and housing demand. For instance, during economic downturns, foreclosure rates tend to rise as homeowners struggle to meet mortgage obligations, flooding the market with potential investment opportunities.

Understanding these trends is critical for investors. By analyzing historical data and current market indicators, investors can predict periods of increased foreclosure activity and position themselves to act swiftly. For more foundational knowledge on foreclosure investing, check out our guide on Foreclosure Investing Basics.

Key Drivers of Distressed Property Market Trends

Several factors drive the fluctuations in the distressed property market. First, macroeconomic conditions play a significant role. Rising interest rates, as seen in recent years, can strain borrowers with adjustable-rate mortgages, leading to higher default rates. Similarly, job losses or stagnant wage growth can push homeowners into financial distress, increasing foreclosure filings.

Legislative changes also impact the market. For example, government interventions like moratoriums on foreclosures during crises (such as the COVID-19 pandemic) can temporarily suppress the supply of distressed properties. Investors must stay updated on policy changes to anticipate shifts in market availability. Additionally, local housing market conditions, such as oversupply or high demand, can influence the pricing and competition for distressed properties. For a deeper dive into legislative impacts, explore our post on Foreclosure Laws and Regulations.

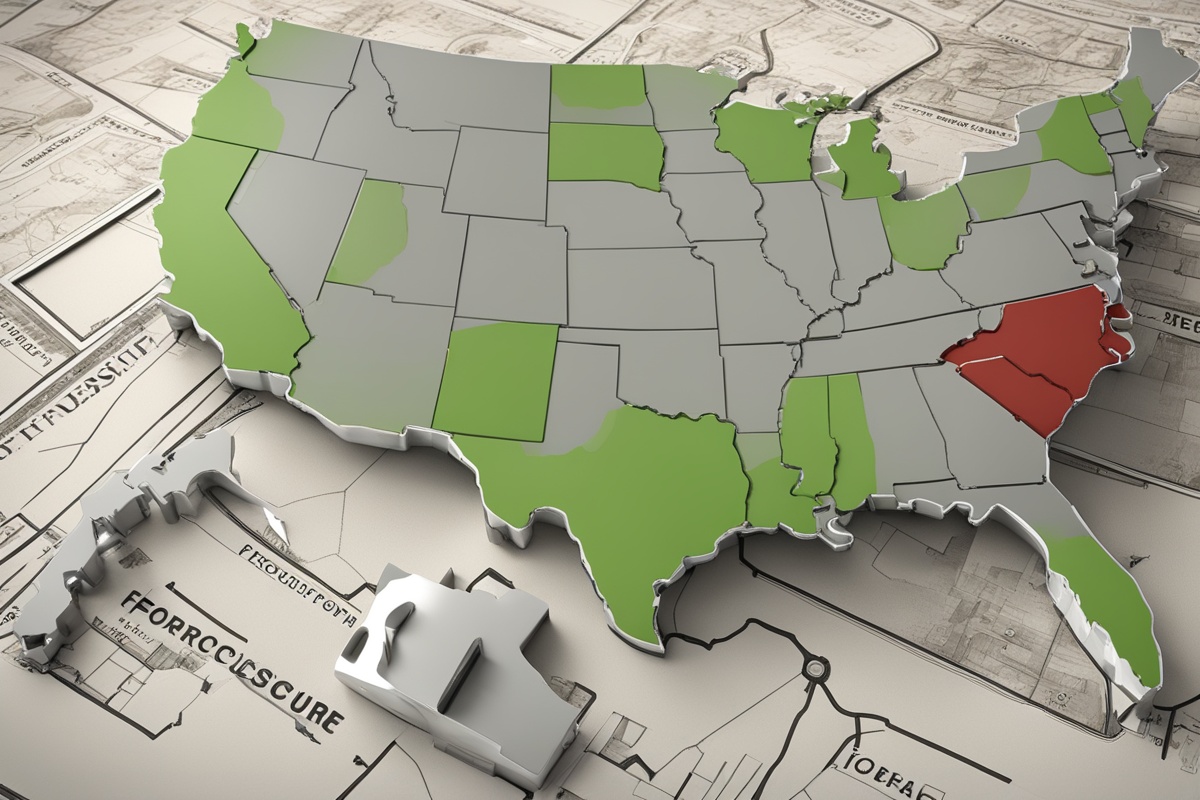

Regional Variations in Distressed Property Trends

Not all distressed property markets are created equal. Regional differences in economic health, housing affordability, and foreclosure laws create varied opportunities for investors. For instance, states with judicial foreclosure processes, like New York and Florida, often have longer timelines for foreclosures, which can delay the availability of properties. In contrast, non-judicial foreclosure states like Texas and California may see faster turnover of distressed properties.

Data from recent reports indicates that areas hardest hit by economic challenges, such as parts of the Midwest, often have higher foreclosure rates compared to booming coastal markets. Investors should conduct localized market analysis to identify regions with high foreclosure activity and favorable investment conditions. To learn more about regional foreclosure processes, read our article on State-Specific Foreclosure Processes.

Current Distressed Property Market Trends in 2023

As of 2023, the distressed property market is experiencing a unique set of trends influenced by post-pandemic recovery and rising interest rates. According to recent data, foreclosure filings have increased by approximately 15% compared to 2022, reflecting the financial strain on homeowners facing higher borrowing costs. However, the market remains below pre-2008 crisis levels, suggesting that while opportunities exist, they are not as abundant as during the Great Recession.

Another notable trend is the growing competition from institutional investors, such as hedge funds, who are increasingly entering the distressed property space. This has driven up prices in some markets, making it essential for individual investors to focus on undervalued niches or less competitive regions. Additionally, the rise of technology platforms for buying foreclosed properties has streamlined the process, allowing investors to access listings and data more efficiently.

Strategies for Capitalizing on Distressed Property Market Trends

For investors looking to succeed in foreclosure investing, adapting to distressed property market trends is key. One effective strategy is to focus on pre-foreclosure properties, where homeowners may be willing to sell at a discount to avoid the stigma and financial impact of foreclosure. Building relationships with local real estate agents and attorneys can provide early access to these deals.

Another approach is leveraging data analytics to identify emerging hotspots for distressed properties. Tools that track foreclosure filings, housing price trends, and economic indicators can help investors pinpoint areas with high potential returns. Lastly, diversifying investments across different regions can mitigate risks associated with localized market downturns. For tips on building a diversified portfolio, see our guide on Diversifying Foreclosure Investments.

Challenges and Risks in the Distressed Property Market

While the distressed property market offers significant opportunities, it is not without challenges. One major risk is the condition of the properties themselves. Many distressed homes require substantial repairs, which can erode profit margins if not accounted for in the initial investment plan. Additionally, legal complexities surrounding foreclosures can lead to delays or disputes, particularly in judicial foreclosure states.

Market volatility is another concern. Rapid changes in interest rates or economic conditions can alter the supply of distressed properties, making timing a critical factor. Investors must also be wary of overpaying in competitive markets, as this can diminish returns. To better understand risk management, review our article on Managing Risks in Foreclosure Investments.

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as financial, legal, or investment advice. Investing in distressed properties and foreclosure markets carries inherent risks, and outcomes can vary based on individual circumstances and market conditions. We recommend consulting with a qualified financial advisor, real estate professional, or legal expert before making any investment decisions. The author and publisher are not responsible for any losses or damages resulting from actions taken based on the content of this article.

References

- ATTOM Data Solutions: 2023 U.S. Foreclosure Market Report

- Federal Reserve: Interest Rates and Housing Market Dynamics (2023)

- RealtyTrac: Foreclosure Market Trends and Analysis

- U.S. Department of Housing and Urban Development: Foreclosure Resources

- National Association of Realtors: Housing Statistics and Market Trends

This content is for informational purposes only and not a substitute for professional advice.