In the ever-evolving landscape of real estate, understanding market dynamics is crucial for investors, developers, and homeowners alike. One area that often garners significant attention during economic uncertainty is distressed properties. These properties, typically sold below market value due to financial distress, foreclosure, or other challenges, present both opportunities and risks. This post dives deep into Evaluating Distressed Property Trends, offering insights into current patterns, influencing factors, and strategies for navigating this niche market.

What Are Distressed Properties?

Distressed properties are real estate assets that are under financial strain, often due to the owner’s inability to maintain mortgage payments, property taxes, or upkeep. These properties may be in foreclosure, short sale, or bank-owned (REO—real estate owned). They are typically sold at a discount, making them attractive to investors looking for bargains. However, evaluating distressed property trends requires a keen understanding of the underlying causes of distress, which can range from individual financial hardship to broader economic downturns.

Distressed properties are not just limited to residential homes; they can include commercial buildings, multifamily units, and even vacant land. Identifying these assets early in the distress cycle can provide a competitive edge, but it also demands thorough due diligence to avoid hidden pitfalls like liens or structural issues.

Key Factors Driving Distressed Property Trends

Several macroeconomic and local factors influence the prevalence of distressed properties in any given market. Evaluating distressed property trends means keeping a pulse on these drivers:

- Economic Conditions: High unemployment rates, inflation, and rising interest rates often lead to increased mortgage defaults, pushing more properties into distress.

- Housing Market Cycles: During a buyer’s market, distressed properties may flood the inventory as sellers struggle to find buyers at desirable prices.

- Legislative Changes: Policies around foreclosure moratoriums or stimulus packages can temporarily reduce or increase the number of distressed properties available.

- Regional Disparities: Areas hit by natural disasters, industrial decline, or population outflow often see spikes in distressed listings.

By analyzing these factors, investors can better predict where and when distressed property opportunities might arise. For more on how economic indicators impact real estate, check out our post on Economic Indicators and Real Estate Markets.

Current Trends in Distressed Properties

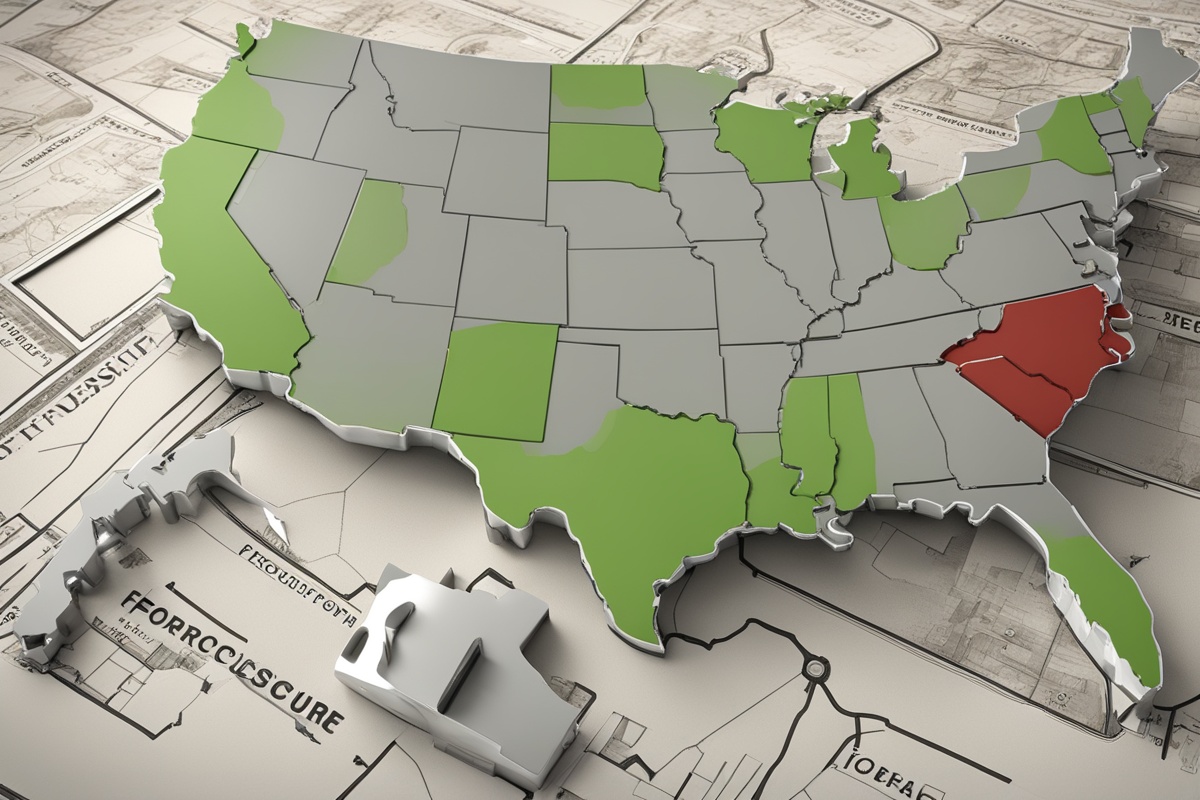

As of recent years, distressed property trends have fluctuated with economic recovery and lingering effects of global events like the COVID-19 pandemic. While foreclosure rates dropped significantly during government-backed moratoriums, a resurgence has been noted in certain markets as protections expire. According to data from reputable real estate analytics, foreclosure filings in the U.S. have risen by over 30% in some states since 2022, signaling a potential wave of distressed opportunities.

Additionally, commercial properties, particularly in the retail and office sectors, have seen increased distress due to shifts in consumer behavior and remote work trends. Investors evaluating distressed property trends should note that urban centers with high vacancy rates are becoming hotbeds for discounted commercial real estate. For a deeper dive into commercial market shifts, see our analysis on Commercial Real Estate in a Post-Pandemic World.

Opportunities and Risks in Distressed Property Investment

Investing in distressed properties can yield high returns, but it’s not without challenges. On the opportunity side, these properties often have lower entry costs, allowing investors to flip them for profit or hold them for long-term appreciation. Markets with high distress rates may also offer less competition, giving savvy buyers a chance to negotiate favorable terms.

However, risks abound. Distressed properties often require significant repairs, and legal complications like title issues or occupant disputes can delay transactions. Moreover, misjudging market recovery timelines can lead to holding costs that erode profits. Investors must weigh these factors carefully when evaluating distressed property trends. For tips on risk mitigation, explore our guide on Navigating Real Estate Investment Risks.

Tools and Strategies for Evaluating Distressed Property Trends

To effectively capitalize on distressed properties, investors need the right tools and strategies. Here are some practical approaches:

- Data Analytics Platforms: Use services like RealtyTrac or CoreLogic to track foreclosure filings, auction dates, and distressed inventory in specific markets.

- Local Market Research: Partner with local real estate agents or attend foreclosure auctions to gain firsthand insight into distressed property availability.

- Financial Modeling: Build detailed projections to account for repair costs, holding periods, and potential resale value before making offers.

- Networking: Connect with banks, asset managers, and wholesalers who often have early access to distressed listings.

Combining these strategies with a solid understanding of market cycles can significantly improve outcomes. For more on leveraging data in real estate, read our post on Harnessing Data Analytics in Real Estate.

Future Outlook for Distressed Property Markets

Looking ahead, evaluating distressed property trends will remain a critical skill for real estate professionals. With interest rates projected to stabilize or decline in some regions, the pace of foreclosures may slow, but pockets of distress will persist in over-leveraged markets or areas facing demographic challenges. Additionally, climate change and natural disasters are expected to create new waves of distressed properties in vulnerable coastal and inland regions.

On the flip side, technological advancements in real estate, such as AI-driven market analysis, could make it easier to identify distressed opportunities before they hit the open market. Staying ahead of these trends will require adaptability and a commitment to continuous learning. For insights into future real estate disruptions, check out our article on Technology Shaping the Future of Real Estate.

Disclaimer: The information provided in this post is for educational and informational purposes only and should not be construed as financial, legal, or investment advice. Investing in distressed properties carries significant risks, and readers are encouraged to consult with qualified professionals, such as financial advisors, real estate agents, or legal counsel, before making any investment decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this content.

References

- RealtyTrac: U.S. Foreclosure Activity Reports

- CoreLogic: Foreclosure and Delinquency Data

- National Association of Realtors: Research and Statistics

- Federal Reserve: Economic Research on Housing Markets

- ATTOM Data Solutions: Foreclosure Trends and Insights

This content is for informational purposes only and not a substitute for professional advice.