In the ever-evolving real estate market, understanding distressed property trends is crucial for investors, homeowners, and industry professionals alike. Distressed properties—homes in foreclosure, short sales, or those facing significant financial or physical distress—present both opportunities and challenges. Evaluating distressed property trends allows stakeholders to make informed decisions, identify potential investments, and mitigate risks in a volatile market. This comprehensive analysis dives into the factors driving distressed property trends, their impact on the broader housing market, and strategies for navigating this complex landscape.

What Are Distressed Properties and Why Do They Matter?

Distressed properties are real estate assets that are under financial or physical strain, often due to owner inability to maintain mortgage payments, property damage, or legal issues such as foreclosure. These properties are typically sold at a discount, making them attractive to investors seeking high returns. However, they often come with hidden costs, legal complications, and repair needs. Evaluating distressed property trends is essential because these properties can significantly influence local housing markets, affect property values, and signal broader economic conditions. For instance, a surge in distressed sales may indicate economic downturns or localized financial struggles, while a decline could suggest recovery.

Understanding the dynamics of distressed properties also helps investors and policymakers address housing affordability issues. By tracking these trends, stakeholders can anticipate market shifts and develop strategies to either capitalize on opportunities or stabilize communities affected by high foreclosure rates. For more insights into general housing market trends, check out our Housing Market Insights page.

Key Factors Driving Distressed Property Trends

Several economic and social factors contribute to the prevalence of distressed properties in a given market. First, macroeconomic conditions such as unemployment rates, interest rate hikes, and inflation play a significant role. When homeowners face job loss or rising borrowing costs, they may struggle to keep up with mortgage payments, leading to foreclosures or short sales. Second, regional disparities in economic health can create pockets of distressed properties, particularly in areas hit hard by industrial decline or natural disasters.

Additionally, policy changes, such as modifications to foreclosure laws or government intervention programs, can either exacerbate or alleviate distressed property trends. For example, during the 2008 financial crisis, a wave of foreclosures flooded the market due to subprime lending practices. In contrast, post-crisis regulations and relief programs helped reduce distressed sales in subsequent years. Staying updated on these factors is critical for anyone looking to evaluate distressed property trends effectively. Learn more about economic influences on real estate in our Economic Factors in Real Estate analysis.

Current Trends in Distressed Property Markets

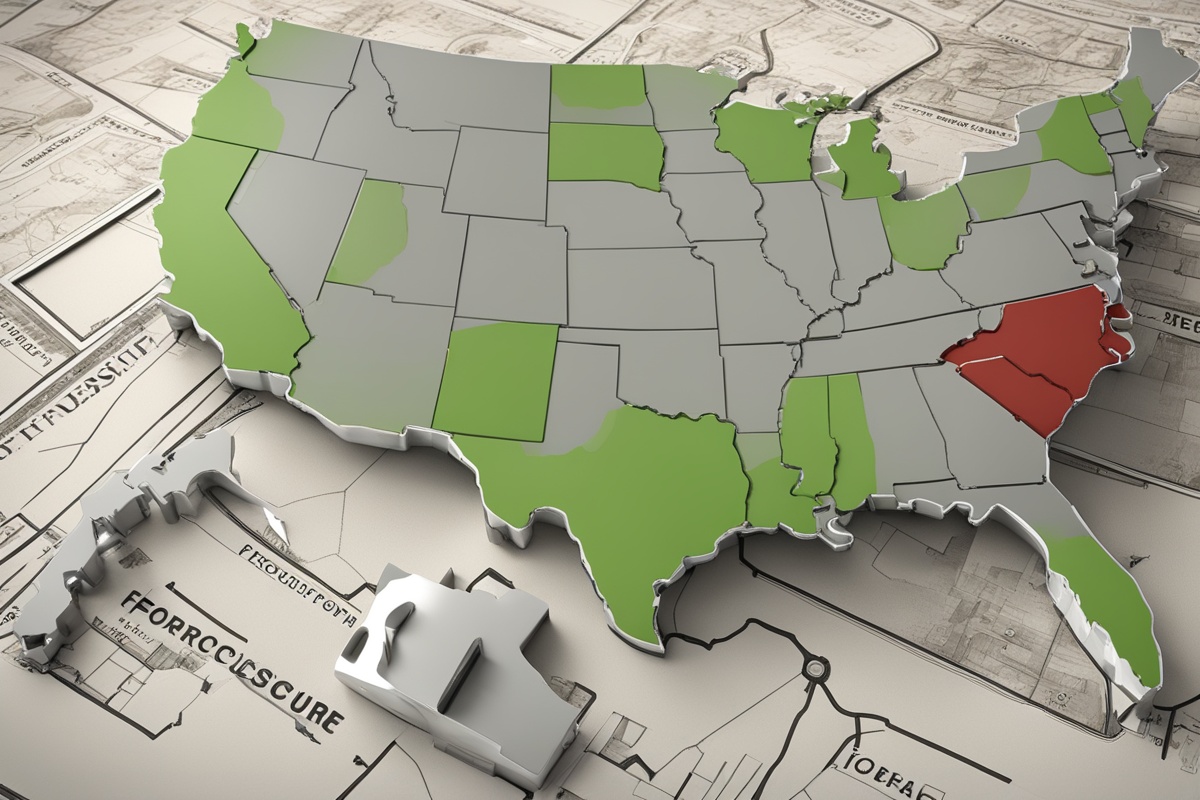

As of recent data, distressed property trends have shown a mixed picture across different regions. In some areas, particularly those recovering from economic downturns or natural disasters, foreclosure rates remain elevated. According to industry reports, markets in the Midwest and parts of the Southeast have seen a slight uptick in distressed sales due to lingering effects of job losses and stagnant wage growth. Conversely, booming urban centers and tech hubs have experienced a decline in distressed properties, driven by strong demand and rising home prices.

Another notable trend is the increasing involvement of institutional investors in the distressed property space. Hedge funds and real estate investment trusts (REITs) are snapping up foreclosed homes in bulk, often converting them into rental properties. This shift has sparked debates about housing affordability and the role of corporate ownership in local markets. Evaluating distressed property trends in this context requires a deep understanding of both local conditions and broader investment patterns. For a deeper dive into investment strategies, explore our guide on Real Estate Investment Strategies.

Challenges in Evaluating Distressed Property Trends

While distressed properties offer lucrative opportunities, evaluating their trends comes with significant challenges. One major hurdle is the lack of comprehensive, up-to-date data. Foreclosure listings and distressed sale records are often fragmented across multiple sources, including county records, private databases, and real estate platforms. This can make it difficult to get a clear picture of market conditions. Additionally, distressed properties are inherently unpredictable—hidden liens, structural issues, or legal disputes can turn a seemingly good deal into a financial burden.

Another challenge is the emotional and ethical dimension of dealing with distressed properties. Many of these homes are tied to personal stories of financial hardship, and investors must navigate these situations with sensitivity. Balancing profitability with social responsibility is a key consideration when evaluating distressed property trends. For tips on ethical real estate practices, refer to our article on Ethical Real Estate Investing.

Strategies for Navigating Distressed Property Investments

For investors looking to capitalize on distressed property trends, a strategic approach is essential. First, thorough due diligence is non-negotiable. This includes researching the property’s title history, assessing repair costs, and understanding local market conditions. Partnering with experienced real estate agents or legal advisors can help uncover potential red flags before committing to a purchase.

Second, diversification is key to mitigating risks. Rather than focusing solely on distressed properties, investors should balance their portfolios with stable assets to cushion against market volatility. Finally, staying informed about legislative changes and economic indicators can provide a competitive edge. For instance, monitoring interest rate forecasts or foreclosure moratoriums can help predict shifts in distressed property availability. To learn more about building a diversified portfolio, check out our post on Diversified Real Estate Portfolios.

The Future of Distressed Property Trends

Looking ahead, distressed property trends are likely to be shaped by a combination of economic recovery patterns, policy decisions, and technological advancements. As the global economy navigates post-pandemic challenges, including inflation and supply chain disruptions, some regions may see a resurgence of distressed sales if financial pressures mount. However, government interventions, such as mortgage forbearance programs, could temper these effects.

Technology is also playing an increasingly important role in how distressed properties are identified and evaluated. Data analytics platforms and machine learning tools are helping investors spot trends and predict foreclosure risks with greater accuracy. As these tools become more accessible, they could democratize the distressed property market, allowing smaller investors to compete with institutional players. The future of evaluating distressed property trends will undoubtedly involve a blend of traditional market analysis and cutting-edge innovation.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as financial, legal, or investment advice. Evaluating distressed property trends involves significant risks, and decisions should be made based on individual circumstances and consultation with qualified professionals. The author and publisher are not responsible for any losses or damages resulting from the use of this content.

References

- Federal Reserve: Distressed Properties and Economic Recovery

- RealtyTrac: Foreclosure Trends Report

- National Association of Realtors: Distressed Sales Statistics

- Urban Institute: Foreclosure Crisis and Community Development

- U.S. Department of Housing and Urban Development: Housing Policy History

This content is for informational purposes only and not a substitute for professional advice.