Navigating the real estate market can feel like walking a tightrope, especially when it comes to distressed properties. These homes, often sold at a discount due to foreclosure, short sales, or significant disrepair, can be a goldmine for savvy investors—or a money pit for the unprepared. So, how do you separate the diamonds in the rough from the disasters waiting to happen? In this deep dive into evaluating distressed property trends, I’ll walk you through the ins and outs of this niche market, blending data-driven insights with practical tips I’ve picked up over years of analyzing real estate deals. Whether you’re a seasoned investor or just dipping your toes into this space, let’s unpack what’s driving these trends and how to make informed decisions.

Disclaimer: This article is for informational purposes only, based on general research and personal experience in the real estate market—it’s not a substitute for professional financial, legal, or real estate advice. The information provided here is meant to offer a broad perspective on distressed property trends, but individual circumstances can vary widely. Always consult a qualified real estate professional, financial advisor, or legal expert for personalized guidance before making investment decisions. I’m sharing insights to help you think critically, but the final call on any property deal rests with you and your trusted advisors.

What Are Distressed Properties, and Why Should You Care?

Distressed properties are essentially homes in some form of financial or physical trouble. Think foreclosures, where the owner couldn’t keep up with mortgage payments, or short sales, where the bank agrees to let the owner sell for less than what’s owed. Then there are properties that are simply neglected—think boarded-up houses with overgrown lawns that haven’t seen a paintbrush in decades. These properties often come with a lower price tag, which is why they’re so tempting. But here’s the kicker: that low price often comes with hidden costs, from legal headaches to renovation nightmares.

Why should you care about evaluating distressed property trends? Because they’re a barometer of the broader economy. When foreclosures spike, it often signals financial strain among homeowners—think the 2008 housing crisis, where distressed properties flooded the market. On the flip side, a low supply of distressed homes might mean a strong economy, but it can also price out investors looking for deals. Understanding these trends isn’t just about snagging a bargain; it’s about timing your moves in a volatile market. Imagine you’re eyeing a foreclosure in a recovering neighborhood—knowing whether distressed sales are trending up or down can tell you if now’s the time to strike or wait for a better deal.

Key Drivers Behind Distressed Property Trends in 2023

Let’s get into the nitty-gritty of what’s shaping distressed property trends today. First off, economic conditions play a huge role. Rising interest rates, like those we’ve seen in 2023, put pressure on homeowners with adjustable-rate mortgages. When payments balloon, some folks just can’t keep up, leading to more foreclosures. According to data from RealtyTrac, foreclosure filings in the first half of 2023 were up 13% compared to the same period in 2022. That’s a red flag for investors to watch, but it also means opportunity if you know where to look.

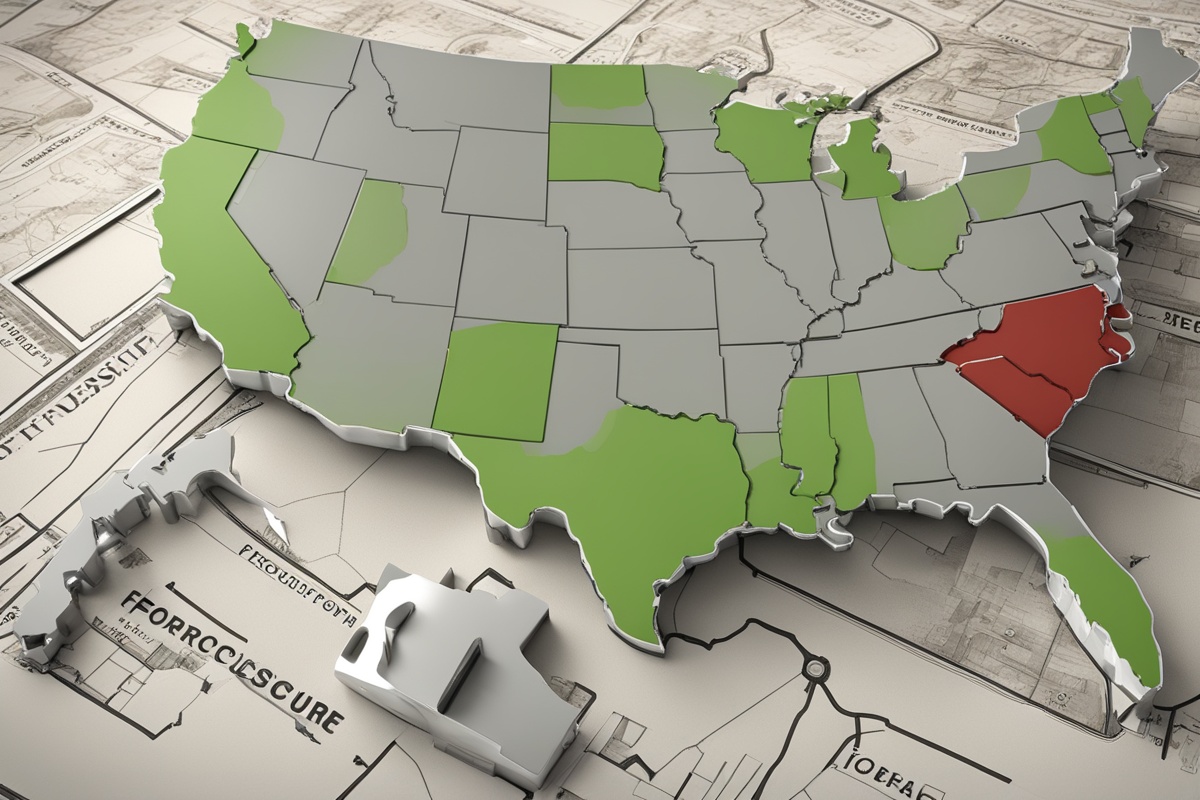

Then there’s the regional factor. Not all markets are created equal when it comes to distressed properties. Take the Rust Belt, for instance—cities like Detroit have long struggled with vacant, distressed homes due to population decline and economic challenges. Contrast that with booming areas like Austin, Texas, where distressed properties are rare because demand keeps prices sky-high. I remember working with a client a few years back who scooped up a foreclosed property in Cleveland for pennies on the dollar, only to flip it for a tidy profit after minor repairs. But the same strategy wouldn’t fly in a hot market like San Diego. So, ask yourself: are you in a buyer’s market for distressed homes, or are you fighting an uphill battle?

Lastly, policy changes can’t be ignored. Government interventions, like foreclosure moratoriums during the COVID-19 pandemic, temporarily halted distressed property sales. Now that those protections are largely lifted, we’re seeing a backlog hit the market. Keeping an eye on local and federal housing policies can give you a leg up in predicting these waves. Check out resources like our post on How Foreclosure Policies Impact Market Trends for a deeper dive into this angle.

Opportunities and Risks of Investing in Distressed Properties

Let’s talk brass tacks: distressed properties can be a fantastic opportunity, but they’re not without pitfalls. On the plus side, the lower purchase price can mean higher profit margins if you flip the property or turn it into a rental. I’ve seen investors buy homes at 30-50% below market value, put in some elbow grease, and come out with six-figure returns. It’s like finding a dusty old painting at a garage sale, only to discover it’s a hidden masterpiece.

But don’t get starry-eyed just yet. The risks are real. Many distressed properties come “as-is,” meaning you’re on the hook for any repairs—and trust me, there will be repairs. From mold to structural damage, the costs can add up fast. Then there’s the legal side. Foreclosures, for instance, might come with liens or back taxes you didn’t anticipate. I once advised a friend who nearly lost his shirt on a short sale because he didn’t do his due diligence on the title. Lesson learned: always, always get a title search. For more on avoiding these traps, see our guide on Due Diligence Tips for Foreclosure Investments.

How to Evaluate Distressed Property Trends Like a Pro

So, how do you get a handle on distressed property trends without drowning in data? Start by tracking local foreclosure rates. Websites like ATTOM Data Solutions provide monthly reports on foreclosure activity by state and county—gold for spotting patterns. Are filings rising in your target area? That might mean more inventory soon, potentially driving prices down. Or are they dropping, signaling a tightening market?

Next, look at the bigger picture. National trends, like unemployment rates or mortgage delinquency stats from the Federal Reserve, can give context to what you’re seeing locally. If joblessness is creeping up, expect more distressed properties as homeowners struggle. I recall analyzing a market in 2019 where delinquency rates spiked months before foreclosures did—those early signals helped my team prepare for a buying spree.

Finally, boots-on-the-ground research is key. Drive through neighborhoods, talk to local agents, and attend foreclosure auctions if you can. Numbers tell part of the story, but seeing a boarded-up house with your own eyes or hearing from a realtor about buyer sentiment adds layers of insight. Curious about auction strategies? Our piece on Winning at Foreclosure Auctions has you covered.

Actionable Tips for Navigating the Distressed Property Market

Ready to take the plunge? Here’s some hard-earned advice to keep you afloat. First, build a solid team. You’ll need a real estate agent familiar with distressed sales, a contractor for repair estimates, and a lawyer to navigate legal hurdles. Going solo is a recipe for disaster—I learned that the hard way early in my career when I skipped a legal consult and got tangled in a messy lien issue.

Second, set a strict budget and stick to it. Factor in not just the purchase price, but also closing costs, repairs, and a buffer for surprises. A good rule of thumb is to aim for a property where your total investment (purchase plus repairs) is at least 30% below the after-repair value (ARV). Third, don’t rush. Distressed properties often sit on the market longer than traditional listings, giving you time to negotiate or walk away if the deal smells fishy.

Lastly, educate yourself continuously. Markets shift, laws change, and trends evolve. Staying ahead means reading up, networking with other investors, and learning from every deal—good or bad. If you’re new to this, start small. Maybe a fixer-upper with cosmetic issues rather than a gut job. Build your confidence, then scale up.

References

- RealtyTrac: 2023 U.S. Foreclosure Market Report

- Federal Reserve: Mortgage Delinquency Rates

- ATTOM Data Solutions: Foreclosure Trends 2023

This content is for informational purposes only and not a substitute for professional advice.