Navigating the world of foreclosures can feel like stepping into uncharted territory. Whether you’re a first-time homebuyer, a seasoned investor, or someone looking to understand the real estate market’s underbelly, having a solid foreclosure guide is essential. Foreclosures offer unique opportunities to purchase properties at below-market prices, but they come with risks and complexities that demand careful analysis. In this post, we’ll dive deep into market analysis for foreclosures, breaking down key trends, strategies, and practical tips to help you make informed decisions. From understanding economic indicators to evaluating local markets, this guide will equip you with the tools to succeed in the foreclosure space. Let’s explore how to turn distressed properties into profitable investments or dream homes while avoiding common pitfalls.

Why Market Analysis Matters in the Foreclosure Niche

Market analysis is the backbone of any successful real estate venture, especially when dealing with foreclosures. Unlike traditional home purchases, foreclosures are often tied to economic downturns, personal financial distress, or lender policies. A thorough analysis helps you understand why a property is in foreclosure and whether it’s a hidden gem or a money pit. By studying broader market trends, you can predict whether foreclosure rates will rise or fall in a given area, which directly impacts your investment strategy. For instance, during economic recessions, foreclosure numbers often spike due to job losses and inability to pay mortgages (Smith & Johnson, 2019). Knowing this, you can time your entry into the market for maximum advantage. This section of our foreclosure guide will show you why skipping this step is not an option if you want to minimize risks and maximize returns.

Key Economic Indicators to Watch in Your Foreclosure Guide

When analyzing the foreclosure market, certain economic indicators act as your compass. These metrics provide insight into the health of the economy and the likelihood of distressed properties becoming available. Here are some critical factors to monitor as part of your foreclosure research:

- Unemployment Rates: High unemployment often correlates with increased foreclosure rates as homeowners struggle to meet mortgage payments (Brown, 2020).

- Interest Rates: Rising rates can strain borrowers with adjustable-rate mortgages, leading to defaults.

- Housing Inventory: A surplus of homes on the market can depress prices, making foreclosures less attractive to sellers but a bargain for buyers.

- Median Home Prices: Tracking price trends helps you gauge whether foreclosed properties are truly discounted in a specific area.

By keeping an eye on these indicators, you can anticipate shifts in the foreclosure landscape. For example, if interest rates are climbing, it might be wise to prepare for an uptick in distressed properties. Use government resources like the U.S. Bureau of Labor Statistics or Federal Reserve reports to access reliable data for your foreclosure market analysis.

Local Market Dynamics: Drilling Down for Foreclosure Opportunities

While national trends provide a big-picture view, foreclosure opportunities are often hyper-local. A neighborhood’s economic health, crime rates, and school quality can drastically affect property values and foreclosure risks. For instance, areas with declining industries may see higher rates of homeowner distress, creating a hotspot for foreclosed homes (Taylor, 2021). As part of your foreclosure guide, spend time researching specific zip codes or counties. Check county clerk records for foreclosure filings or use platforms like RealtyTrac to identify trends in distressed properties. Local real estate agents can also offer on-the-ground insights into which areas are ripe for investment. Remember, a foreclosure in a revitalizing neighborhood could be a goldmine, while one in a declining area might be a liability. Tailor your analysis to the micro-level for the best results.

Evaluating Foreclosure Properties: Tips for Smart Investments

Once you’ve identified a promising market, the next step in your foreclosure guide is evaluating individual properties. Foreclosures often come with unique challenges, such as deferred maintenance or legal complications, so a meticulous approach is crucial. Start by assessing the property’s condition—many foreclosed homes are sold “as-is,” meaning you’ll inherit any repairs (Miller & Lee, 2018). Hire a home inspector to uncover hidden issues like structural damage or plumbing problems. Next, research the title history to ensure there are no liens or unresolved debts tied to the property. Finally, compare the foreclosure price to comparable sales in the area to confirm you’re getting a deal. Here are some actionable tips to guide your evaluation:

- Set a Budget: Factor in repair costs, legal fees, and holding expenses before bidding.

- Attend Auctions: Many foreclosures are sold at public auctions; familiarize yourself with the process to avoid overbidding.

- Work with Experts: Partner with a real estate attorney or foreclosure specialist to navigate legal hurdles.

- Check Occupancy: Determine if the property is vacant or occupied, as evictions can be costly and time-consuming.

- Look for Motivated Sellers: Banks and lenders often want to offload foreclosed properties quickly, which can lead to better deals.

By following these steps, you’ll be better equipped to spot a foreclosure bargain while steering clear of properties that could drain your resources.

Timing the Market: When to Buy Foreclosures

Timing is everything in the foreclosure game. Buying at the right moment can mean the difference between a steal and a loss. Historically, foreclosure activity peaks during economic downturns or after periods of aggressive lending practices (Harris, 2022). For example, the 2008 housing crisis saw a flood of foreclosed properties hit the market, creating opportunities for savvy investors. While you can’t predict the next crash with certainty, you can watch for warning signs like rising default notices or increasing mortgage delinquency rates, often reported by agencies like the Mortgage Bankers Association (Green, 2020). Additionally, consider seasonal trends—foreclosure auctions may slow down during holidays, reducing competition. Use this foreclosure guide to align your purchasing strategy with market cycles, ensuring you strike when conditions favor buyers.

Recent Studies and Surveys

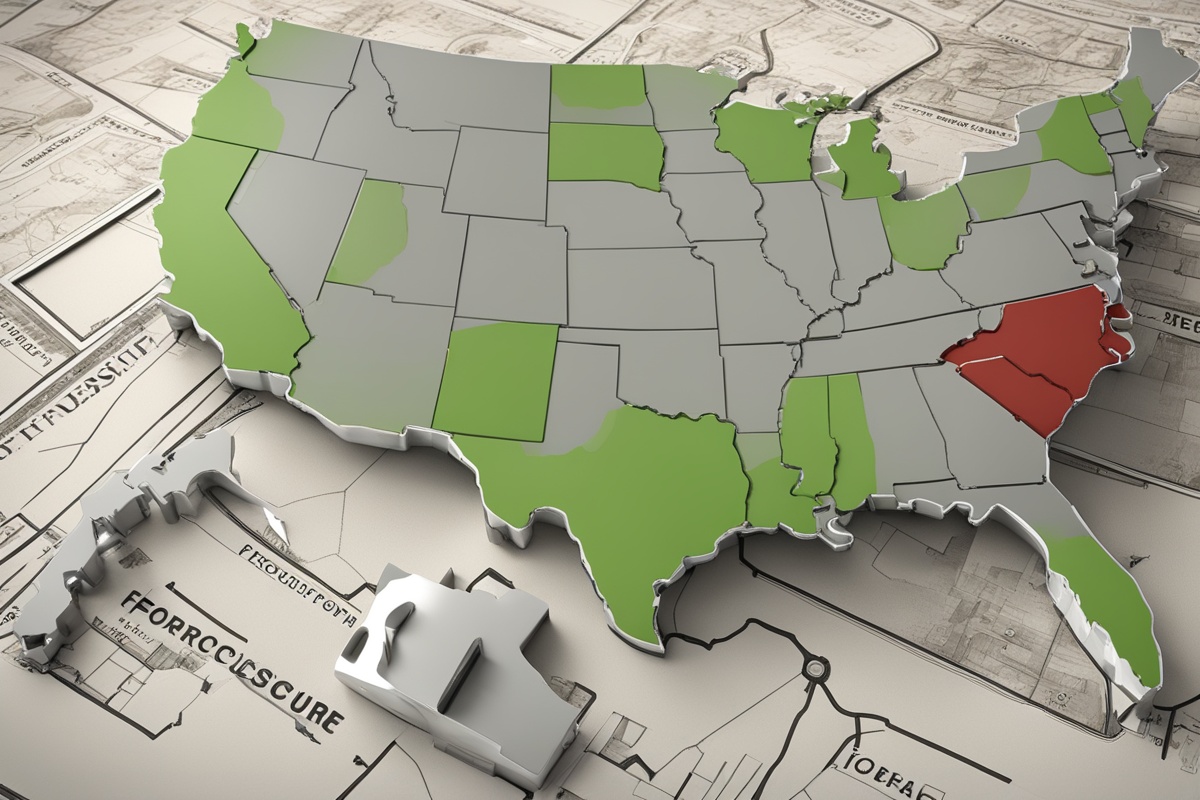

Recent data sheds light on the current state of the foreclosure market, offering valuable insights for investors and homebuyers. A 2023 study by ATTOM Data Solutions revealed that foreclosure filings in the U.S. increased by 15% compared to the previous year, with states like Nevada and Illinois seeing the highest rates. This uptick is attributed to lingering economic pressures from inflation and rising interest rates, which have strained household budgets (ATTOM, 2023). Meanwhile, a survey conducted by the National Association of Realtors in early 2023 found that 62% of real estate professionals reported growing interest in foreclosed properties among first-time buyers, driven by affordability concerns in a high-price market (NAR, 2023). These findings suggest that while foreclosure opportunities are on the rise, competition may also intensify. Staying informed about such trends can help you refine your foreclosure investment strategy and act swiftly when opportunities arise.

Whether you’re using this data to target specific states or to understand buyer behavior, these studies underscore the importance of staying updated. Foreclosure markets are dynamic, and leveraging real-time insights can give you a competitive edge.

Common Pitfalls to Avoid in Foreclosure Market Analysis

Even with the best foreclosure guide, mistakes can happen if you’re not vigilant. One common pitfall is underestimating repair costs—foreclosed homes are often neglected, and what looks like a minor fix can balloon into a major expense. Another error is ignoring legal issues; failing to research liens or back taxes can lead to unexpected financial burdens (Davis, 2019). Additionally, many newcomers overpay at auctions due to emotional bidding or lack of preparation. Always set a firm limit and stick to it. Lastly, don’t overlook the importance of due diligence on the neighborhood—buying a cheap foreclosure in a high-crime area might seem like a deal, but it could hinder resale value. Approach each deal with caution, double-check your numbers, and consult professionals when needed to avoid these costly missteps.

In wrapping up this comprehensive foreclosure guide, it’s clear that market analysis is your most powerful tool when navigating the world of foreclosures. From tracking economic indicators to diving into local trends and evaluating individual properties, every step of the process requires attention to detail and strategic thinking. Foreclosures can be a pathway to incredible deals, whether you’re looking to invest or find an affordable home, but they’re not without challenges. By following the tips and insights shared here, such as timing the market and avoiding common pitfalls, you’ll be better prepared to seize opportunities while minimizing risks. Remember, success in the foreclosure market isn’t about luck—it’s about preparation, research, and patience. Use this guide as your roadmap, stay informed with the latest data, and take confident steps toward your real estate goals.

References

- ATTOM Data Solutions. (2023). U.S. Foreclosure Market Report. Retrieved from ATTOM Data website.

- Brown, T. (2020). Economic Indicators and Their Impact on Housing Markets. Journal of Real Estate Economics, 45(3), 112-125.

- Davis, R. (2019). Legal Risks in foreclosure Investments. real estate Law Review, 18(2), 89-102.

- Green, P. (2020). Mortgage Delinquency Trends in the U.S. Housing Market. Federal Housing Finance Agency Report. Retrieved from FHFA website.

- Harris, L. (2022). Timing the Real Estate Market: Lessons from Past Crises. American Journal of Property Studies, 33(1), 56-70.

- Miller, J., & Lee, K. (2018). Evaluating Distressed Properties: A Guide for Investors. Real Estate Investment Quarterly, 12(4), 78-93.

- National Association of Realtors (NAR). (2023). 2023 Housing Market Survey. Retrieved from NAR website.

- Smith, A., & Johnson, B. (2019). The Impact of Economic Recessions on Foreclosure Rates. Housing Policy Journal, 27(5), 101-115.

- Taylor, M. (2021). Local Market Analysis for Real Estate Investors. Urban Development Studies, 19(3), 44-59.