In the ever-evolving real estate landscape, understanding distressed property trends is crucial for investors, homeowners, and industry professionals. Distressed properties, often sold at a discount due to foreclosure, short sales, or owner financial distress, present both opportunities and challenges. Navigating distressed property trends requires a deep dive into market dynamics, economic indicators, and strategic approaches to capitalize on these unique assets. This comprehensive guide explores the current state of distressed properties, offering actionable insights for those looking to invest or understand this niche market.

Understanding Distressed Properties and Their Market Impact

Distressed properties are real estate assets sold under financial duress, often due to the owner’s inability to maintain mortgage payments or other debts. These properties can include foreclosures, bank-owned real estate (REO), and short sales. The market impact of distressed properties is significant, as they often influence local housing prices, inventory levels, and buyer sentiment. In periods of economic downturn, such as during the 2008 financial crisis, distressed properties flooded the market, driving down home values. Today, while the volume of distressed sales has decreased, they remain a critical segment for investors seeking undervalued opportunities. Understanding the factors driving these trends—such as unemployment rates, interest rate hikes, and regional economic conditions—is the first step in navigating distressed property trends effectively.

Current Trends in Distressed Property Sales

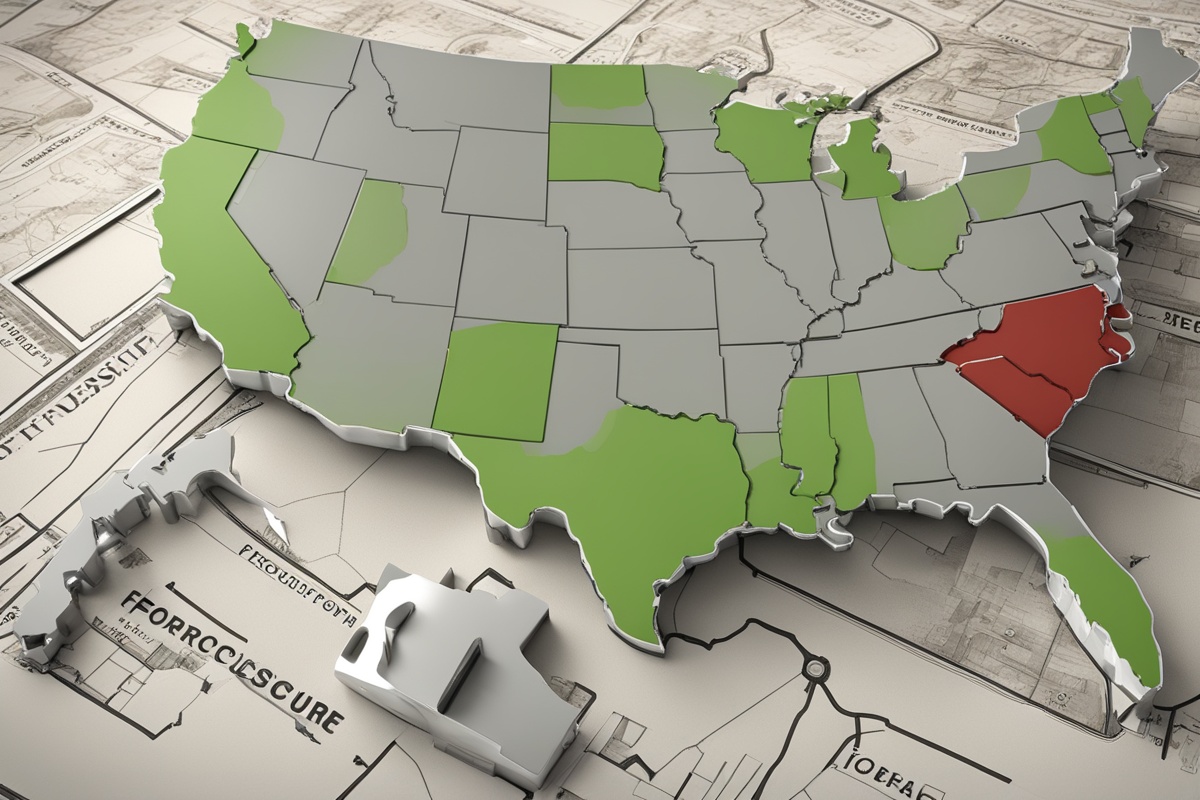

As of recent years, distressed property sales have seen fluctuations tied to broader economic conditions. According to data from the National Association of Realtors (NAR), foreclosure rates have remained relatively low compared to the post-2008 era, thanks to stronger economic recovery and government interventions like mortgage forbearance programs during the COVID-19 pandemic. However, with rising interest rates and inflation pressures in 2023, some markets are witnessing a gradual uptick in distressed listings. Hotspots for distressed properties include areas with high unemployment or over-leveraged homeowners, such as certain regions in the Midwest and parts of the Southeast. For investors, staying updated on these trends through platforms like our Real Estate Market Updates page can provide a competitive edge in identifying emerging opportunities.

Factors Driving Distressed Property Trends

Several macroeconomic and microeconomic factors contribute to the rise or fall of distressed property trends. On a macro level, interest rate hikes by the Federal Reserve can strain borrowers with adjustable-rate mortgages, leading to payment defaults. Inflation erodes purchasing power, making it harder for homeowners to cover living expenses alongside mortgage obligations. On a micro level, personal financial crises—such as job loss, medical emergencies, or divorce—often precipitate property distress. Additionally, regional disparities play a role; areas with declining industries or natural disaster risks may see higher rates of distressed sales. Keeping a pulse on these drivers through resources like our Economic Indicators for Real Estate guide can help stakeholders anticipate market shifts.

Strategies for Navigating Distressed Property Investments

Investing in distressed properties can yield high returns, but it requires careful planning and risk management. First, conduct thorough due diligence on the property’s condition and legal status—many distressed homes come with liens, title issues, or significant repair needs. Second, leverage local market data to ensure the investment aligns with long-term appreciation potential; our Local Market Analysis tool is an excellent resource for this. Third, consider financing options tailored for distressed purchases, such as hard money loans or FHA 203(k) loans for rehabilitation. Lastly, build a network of professionals, including real estate agents specializing in foreclosures and contractors for renovations, to streamline the process. These strategies can mitigate risks while maximizing the potential of distressed property investments.

Challenges and Risks in the Distressed Property Market

While the rewards can be substantial, navigating distressed property trends comes with inherent challenges. Properties often require extensive repairs, inflating the total cost of ownership beyond initial estimates. Legal complications, such as unresolved liens or tenant eviction issues, can delay or derail transactions. Market timing is another hurdle—buying at the peak of a distressed wave may lead to overpaying if prices continue to decline. Moreover, emotional factors, such as dealing with homeowners in financial hardship, can complicate negotiations. Investors must weigh these risks against potential gains and stay informed through resources like our Real Estate Risk Management section to make sound decisions.

Future Outlook for Distressed Property Trends

Looking ahead, the trajectory of distressed property trends will likely hinge on economic policies, housing affordability, and consumer confidence. If interest rates stabilize and inflation cools, the volume of distressed sales may remain subdued. However, persistent economic uncertainty or a recession could reignite foreclosure activity, particularly in vulnerable markets. Technological advancements, such as AI-driven real estate analytics, are also shaping how investors identify and act on distressed opportunities. For a deeper dive into predictive market trends, explore our Future of Real Estate Markets analysis. Staying proactive and adaptable will be key for anyone navigating this dynamic segment of the real estate industry.

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as financial, legal, or investment advice. Navigating distressed property trends involves significant risks, and outcomes can vary based on individual circumstances and market conditions. Readers are encouraged to consult with qualified professionals, such as real estate agents, financial advisors, or legal counsel, before making any investment decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this content.

References

- National Association of Realtors (NAR) – Research and Statistics

- Federal Reserve – Monetary Policy

- U.S. Department of Housing and Urban Development (HUD) – FHA 203(k) Loan Program

- Bureau of Labor Statistics (BLS) – Employment Situation Summary

- CoreLogic – Foreclosure Data and Insights

This content is for informational purposes only and not a substitute for professional advice.