In the ever-evolving real estate landscape, understanding and navigating distressed property trends is a critical skill for investors, real estate professionals, and even homeowners looking to capitalize on unique opportunities. Distressed properties—homes or commercial spaces that are in financial or physical distress—often present lucrative investment potential, but they also come with significant risks. This comprehensive guide delves into the intricacies of distressed property trends, offering actionable insights to help you make informed decisions in this niche market.

Understanding Distressed Properties: What They Are and Why They Matter

Distressed properties refer to real estate assets that are under financial strain, often due to foreclosure, bankruptcy, or owner inability to maintain the property. These properties can also be physically distressed, requiring significant repairs or renovations. The importance of navigating distressed property trends lies in the potential for high returns on investment. Buying a property at a discounted price, rehabilitating it, and selling or renting it can yield substantial profits. However, the market for distressed properties fluctuates based on economic conditions, interest rates, and regional housing dynamics, making it essential to stay informed about current trends.

For instance, during economic downturns, the number of distressed properties typically rises as more homeowners struggle to meet mortgage payments. Recognizing these patterns allows investors to position themselves strategically. To dive deeper into general real estate market trends that influence distressed properties, check out our Real Estate Market Trends 2023 post.

Key Factors Driving Distressed Property Trends in 2023

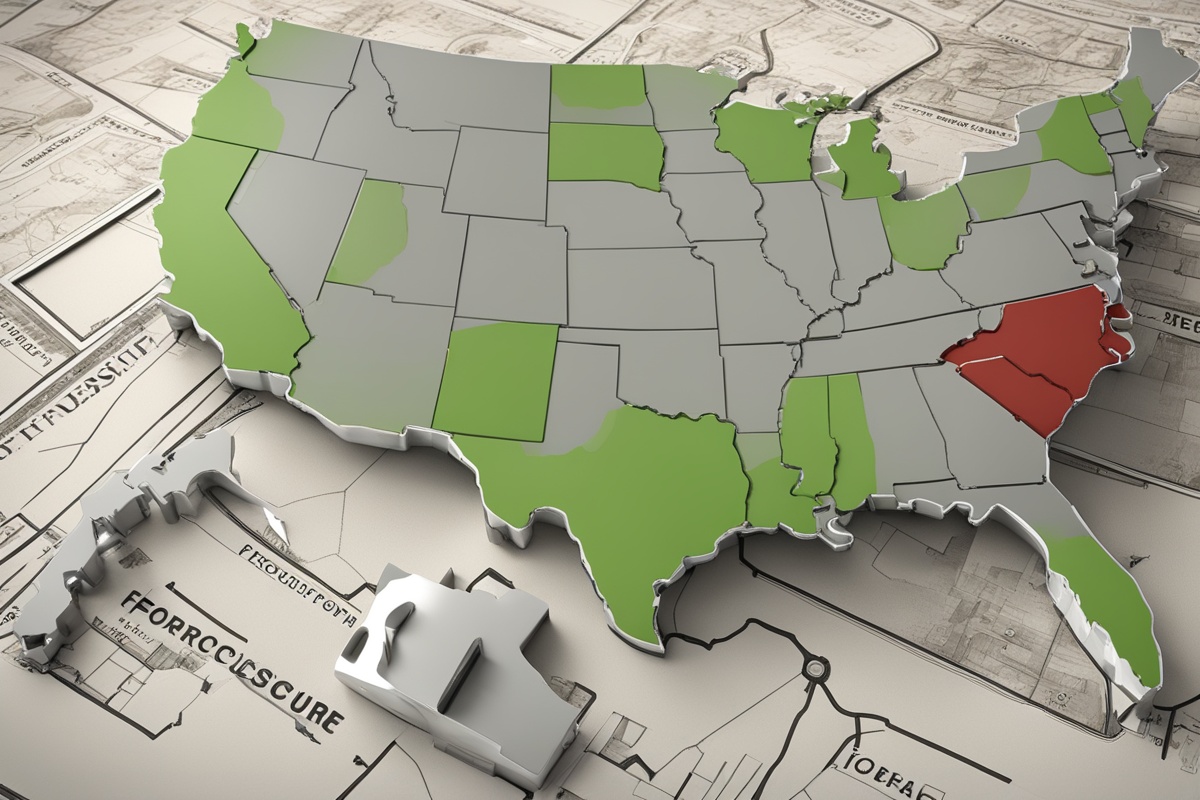

Several macroeconomic and regional factors are shaping distressed property trends this year. Rising interest rates have increased mortgage payments for many homeowners, leading to a spike in defaults and foreclosures in certain markets. Additionally, lingering effects of the post-pandemic economy, such as job losses in specific sectors, have contributed to financial distress for property owners. According to recent data, foreclosure filings in the U.S. have increased by over 15% year-over-year in some states, signaling a growing pool of distressed properties.

Regional disparities also play a significant role. Areas with declining industrial activity or high unemployment rates tend to have more distressed properties, while booming markets may see fewer opportunities. Investors navigating distressed property trends must analyze local market conditions to identify high-potential areas. For more on regional real estate dynamics, explore our Regional Housing Market Analysis guide.

Strategies for Identifying and Acquiring Distressed Properties

Finding distressed properties requires a proactive approach and a keen eye for opportunity. One effective strategy is to work with local real estate agents who specialize in foreclosures or short sales. Additionally, public records such as foreclosure notices and bankruptcy filings can provide leads on distressed properties before they hit the open market. Online platforms and auctions are also valuable resources for uncovering hidden gems.

Once identified, acquiring a distressed property often involves negotiating with banks, lienholders, or owners in financial distress. Patience and due diligence are key, as these transactions can be complex and time-consuming. Investors should also be prepared to assess the property’s condition and estimate repair costs accurately to avoid overpaying. For tips on property evaluation, refer to our Property Investment Evaluation Guide.

Navigating Risks Associated with Distressed Properties

While the potential rewards of investing in distressed properties are high, so are the risks. One major challenge is the uncertainty surrounding the property’s title. Liens, back taxes, or legal disputes can complicate ownership and lead to unexpected costs. Additionally, distressed properties often require significant renovations, and underestimating repair expenses can erode profit margins.

Market risk is another factor to consider. If the local real estate market declines further after purchasing a distressed property, selling or renting it at a profit may become difficult. Investors must conduct thorough market research and risk assessments before committing to a purchase. To learn more about mitigating real estate investment risks, see our Real Estate Investment Risks article.

Financing Options for Distressed Property Investments

Financing a distressed property purchase can be more challenging than securing a traditional mortgage. Many lenders are hesitant to finance properties in poor condition or with unclear titles. As a result, investors often turn to alternative financing options such as hard money loans, private lenders, or cash purchases. Hard money loans, for instance, are short-term loans secured by the property itself, often with higher interest rates but more flexible approval criteria.

Another option is to partner with other investors to pool resources and share risks. Government programs, such as those offered by the Department of Housing and Urban Development (HUD), may also provide opportunities to acquire distressed properties at a discount. Understanding financing options is crucial for successfully navigating distressed property trends. For a broader look at real estate financing, check out our Real Estate Financing Options resource.

Future Outlook: What to Expect in Distressed Property Markets

Looking ahead, the distressed property market is likely to remain dynamic as economic conditions continue to evolve. Analysts predict that ongoing inflationary pressures and potential recessionary risks could lead to an increase in distressed properties in the near term. However, government interventions, such as mortgage forbearance programs, may temper the volume of foreclosures in some regions.

For investors, staying ahead of the curve means monitoring economic indicators, interest rate changes, and housing policy updates. Leveraging technology, such as real estate analytics tools, can also provide a competitive edge in identifying emerging opportunities. As the market shifts, adaptability and informed decision-making will be key to navigating distressed property trends effectively.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as financial, legal, or investment advice. Investing in distressed properties carries significant risks, and readers are encouraged to consult with qualified professionals, including financial advisors, real estate experts, and legal counsel, before making any investment decisions. The author and publisher are not responsible for any losses or damages resulting from actions taken based on the content of this article.

References

- ATTOM Data Solutions: 2023 U.S. Foreclosure Market Report

- U.S. Department of Housing and Urban Development: Buying a Home

- Federal Reserve: Impact of Rising Interest Rates on Housing (2023)

- Realtor.com: 2023 Housing Market Forecasts

- National Association of Realtors: Housing Statistics

This content is for informational purposes only and not a substitute for professional advice.