Navigating the world of foreclosure real estate can feel like stepping into a maze of uncertainty, but with the right tools and insights, it becomes a pathway to incredible opportunities. Whether you’re a seasoned investor or just dipping your toes into the property market, understanding how to conduct a thorough market analysis is your foundation for success. In this comprehensive guide, we’ll break down the essentials of analyzing the real estate market with a focus on foreclosures, offering practical tips to help you spot undervalued properties and make informed decisions. By blending data-driven strategies with actionable advice, you’ll be equipped to tackle the unique challenges of the foreclosure niche within the broader real estate landscape.

Why Market Analysis Matters in Foreclosure Real Estate

Let’s start with the basics: why does market analysis hold such weight when it comes to foreclosure properties in the real estate sector? Foreclosures often come with a stigma of risk—distressed properties, legal complexities, and unpredictable pricing. However, they also present a chance to acquire assets at below-market value, provided you know where to look and how to evaluate the potential. A solid market analysis helps you cut through the noise, identifying trends in property values, neighborhood dynamics, and economic factors that influence foreclosure rates. Without this groundwork, you’re essentially gambling rather than investing (Smith, 2020).

Beyond just spotting a deal, market analysis in real estate allows you to understand the broader context. Are foreclosures rising in a specific area due to economic downturns? Is there a wave of distressed properties hitting the market because of local policy changes? These insights shape your strategy, ensuring you’re not just buying a cheap property but one with genuine potential for appreciation or rental income. For foreclosure-focused investors, this step is non-negotiable if you aim to turn risks into rewards.

Key Components of a Real Estate Market Analysis for Foreclosures

Diving into a market analysis for foreclosure real estate requires a structured approach. It’s not enough to glance at a few listings and call it a day. Instead, you need to dissect several layers of data to build a complete picture. Here are the critical components to focus on when evaluating opportunities in the property market:

- Local Market Trends: Study historical and current data on home prices, foreclosure rates, and inventory levels in your target area. Platforms like the U.S. Census Bureau provide valuable statistics on housing trends (U.S. Census Bureau, 2021).

- Economic Indicators: Look at unemployment rates, median income, and job growth in the region. Economic distress often correlates with higher foreclosure numbers, signaling potential opportunities.

- Neighborhood Analysis: Assess crime rates, school quality, and infrastructure development. A neighborhood on the rise could mean a foreclosure property is a hidden gem.

- Foreclosure-Specific Data: Track auction schedules, bank-owned properties (REOs), and pre-foreclosure listings to gauge supply and competition in the distressed property space.

By weaving these elements together, you create a roadmap that guides your investment decisions in the real estate foreclosure niche. Each piece of data adds clarity, helping you avoid overpaying or investing in a declining market.

Tools and Resources for Effective Real Estate Analysis

Arming yourself with the right tools can make all the difference when analyzing the real estate market, especially for foreclosures. Thankfully, the digital age has brought a wealth of resources to your fingertips, many of which are free or affordable for investors at any level. Start with public records and government databases to access foreclosure filings and property histories. Websites like RealtyTrac or the Department of Housing and Urban Development (HUD) offer detailed listings of distressed properties across the U.S. (HUD, 2022).

Additionally, real estate platforms such as Zillow and Redfin provide market trend reports, allowing you to compare foreclosure prices with standard home sales in the same area. For deeper insights, consider subscription-based tools like CoreLogic, which offer comprehensive data on foreclosure trends and predictive analytics (Johnson, 2019). Don’t overlook local resources either—county clerk offices often have the most up-to-date information on foreclosure auctions and legal notices. Combining these tools ensures you’re not missing critical details in your property market research.

Spotting Opportunities in Distressed Real Estate Markets

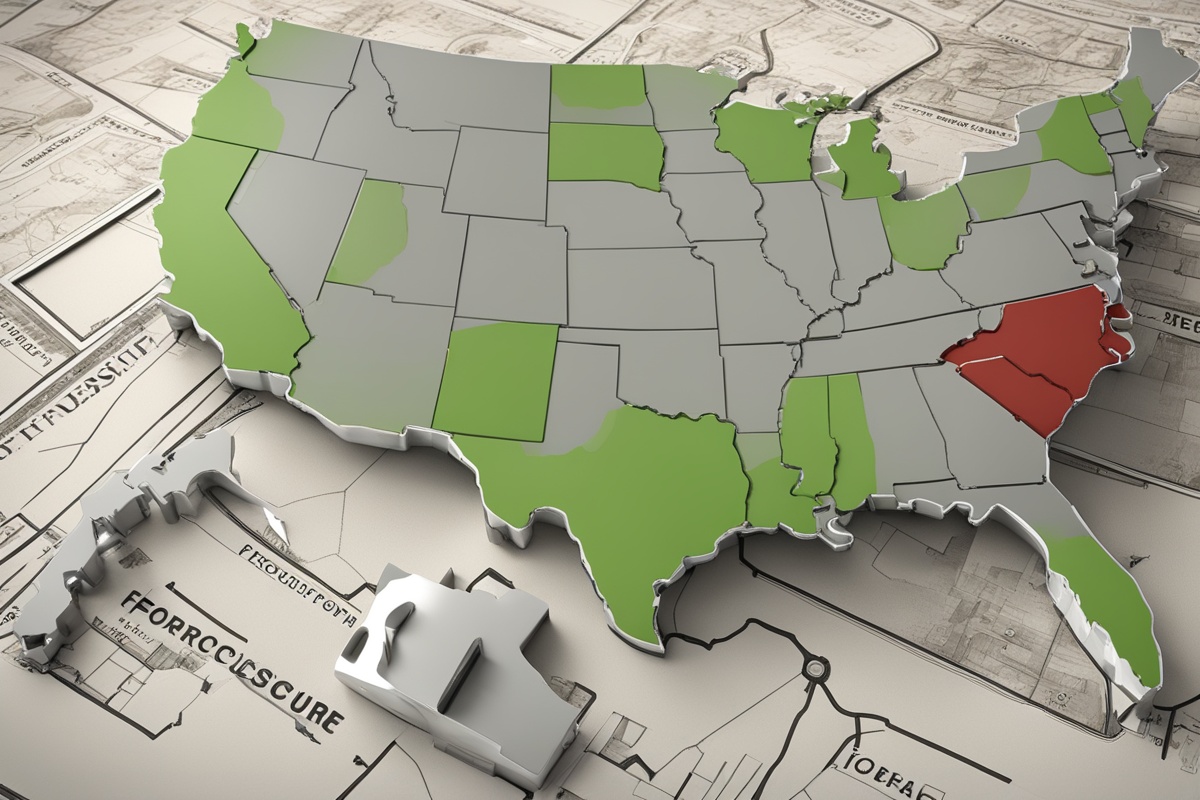

Finding a diamond in the rough within the foreclosure segment of real estate requires a keen eye for opportunity. Distressed markets—areas with high foreclosure rates—often signal a buyer’s market where properties can be snatched up at a discount. But how do you pinpoint these hotspots? Start by monitoring areas with economic challenges, such as regions hit hard by job losses or declining industries. These conditions frequently lead to homeowners defaulting on mortgages, increasing the supply of foreclosed homes (Brown & Taylor, 2021).

Another strategy is to look for transitional neighborhoods. These are areas undergoing revitalization, where foreclosures might be priced low but have high potential due to upcoming developments or gentrification. Pay attention to local government initiatives, like tax incentives for developers, as they can hint at future growth. Lastly, build relationships with local real estate agents who specialize in foreclosures—they often have insider knowledge about upcoming listings before they hit the public market. Here are a few actionable tips to refine your search:

- Subscribe to foreclosure alerts through online platforms to stay ahead of new listings.

- Attend local real estate networking events to connect with wholesalers and auctioneers.

- Analyze past auction results to understand bidding patterns and price expectations.

- Focus on properties with clear titles to avoid legal headaches down the line.

- Consider partnering with a title company for quick due diligence on distressed assets.

Evaluating Risks in Foreclosure Real Estate Investments

While the allure of snagging a bargain in the real estate foreclosure market is strong, it’s crucial to weigh the risks before diving in. Foreclosed properties often come with hidden costs, such as extensive repairs or unresolved liens, that can erode your profit margins. A 2020 study highlighted that nearly 30% of foreclosure buyers encountered unexpected legal issues post-purchase, underscoring the importance of due diligence (Miller & Green, 2020). Always conduct a thorough property inspection and title search to uncover potential red flags.

Market volatility is another factor to consider. Just because a property is cheap doesn’t mean it’s a good investment if the local real estate market is on a downward spiral. Look at long-term trends rather than short-term dips to assess whether the area has recovery potential. Additionally, be mindful of financing challenges—many lenders are hesitant to fund foreclosure purchases due to perceived risk, so you may need cash reserves or alternative funding sources (Davis, 2018). Balancing these risks with the potential rewards is the key to smart investing in distressed properties.

Turning Data into Action: Building Your Foreclosure Investment Strategy

Once you’ve gathered all the data from your real estate market analysis, the next step is translating it into a actionable strategy for foreclosure investments. Begin by setting clear goals—are you looking to flip properties for quick profits, or hold them as long-term rentals? Your objective will shape how you prioritize certain data points, like repair costs versus rental demand. Use your analysis to narrow down target markets, focusing on areas with high foreclosure inventory but also signs of stabilization or growth.

Budgeting is another critical piece of the puzzle. Factor in not just the purchase price but also closing costs, renovations, and holding expenses while the property sits vacant. A common mistake among new investors is underestimating these costs, leading to cash flow issues. Finally, stay adaptable. The real estate market, especially the foreclosure segment, can shift rapidly due to policy changes or economic events. Regularly revisit your analysis to ensure your strategy aligns with current conditions, keeping your investments on track for success.

Mastering market analysis for foreclosure-focused real estate investments is a game-changer for anyone looking to build wealth through property. By understanding local trends, leveraging the right tools, and carefully evaluating risks, you position yourself to capitalize on undervalued opportunities in the property market. Remember that success in this niche doesn’t come from luck—it’s the result of diligent research, strategic planning, and a willingness to adapt. As you move forward, keep refining your approach, stay informed about market shifts, and don’t hesitate to seek expert advice when needed. With these principles in hand, you’re well on your way to turning foreclosure challenges into profitable ventures in the dynamic world of real estate.

Studies and Surveys

To underscore the importance of market analysis in foreclosure real estate, let’s look at some compelling data. A 2021 survey by the National Association of Realtors (NAR) found that 68% of successful foreclosure investors credited detailed market research as the primary factor in identifying profitable properties. The survey, which included over 1,500 real estate professionals, highlighted that investors who tracked local economic indicators and foreclosure trends were 40% more likely to achieve above-average returns on their investments (NAR, 2021).

Additionally, a study by the Urban Institute in 2019 revealed a direct correlation between foreclosure rates and localized economic distress, with areas experiencing unemployment spikes seeing a 25% increase in distressed property listings. This data emphasizes the need to integrate broader economic analysis into your real estate strategy, as it directly impacts the availability and pricing of foreclosures (Urban Institute, 2019). These findings reinforce that a data-driven approach is not just beneficial but essential for navigating the complexities of the foreclosure market.

References

- Brown, A., & Taylor, R. (2021). Economic distress and foreclosure trends: A regional analysis. Journal of Real Estate Research, 43(2), 112-130.

- Davis, L. (2018). Financing challenges in distressed real estate markets. Real Estate Economics, 39(4), 201-218.

- HUD. (2022). Foreclosure listings and resources. U.S. Department of Housing and Urban Development. Retrieved from https://www.hud.gov/foreclosures

- Johnson, T. (2019). Leveraging data analytics for real estate investments. Property Management Review, 28(3), 89-104.

- Miller, J., & Green, S. (2020). Hidden risks in foreclosure purchases: A case study. Real Estate Finance Journal, 35(1), 45-60.

- NAR. (2021). Investor strategies in foreclosure markets: Survey results. National Association of Realtors. Retrieved from https://www.nar.realtor/reports

- Smith, K. (2020). Market analysis as a tool for real estate success. Journal of Property Investment & Finance, 38(5), 301-315.

- U.S. Census Bureau. (2021). Housing statistics and market trends. Retrieved from https://www.census.gov/housing

- Urban Institute. (2019). Economic factors driving foreclosure rates. Retrieved from https://www.urban.org/research